Stocks Performance (U.S. Stocks)

Stocks began and finished the week on a strong note, though worries remained about the continuing resurgence of the coronavirus across the South and Southwest, and governors in several states announced reversals or pauses in reopening plans.

However, and optimism about progress in developing a vaccine may have helped support sentiment. Wednesday brought news of encouraging early-stage test results for a vaccine under joint development by Pfizer and BioNTech, and investors seemed further encouraged by the companies’ aggressive timeline for possible regulatory approval. In other positive developments, Boeing resumed 737 MAX flights for certification and Tesla shares surged 26%.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at 5.13%, followed by Process Industries at 3.34%, Retail Trade at 2.98%, and Producer Manufacturing (2.75%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-0.84%), Finance (-4.90%), Industrial Services (0.04%) and Communications sector (0.13%).

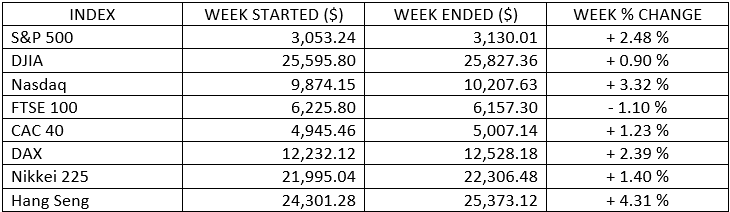

Indices Performance

Technology-heavy Nasdaq Composite Index to a record intraday high, while the S&P 500 Index touched its best level since June 10. Within the S&P 500, communication services shares were particularly strong, helped by gains in Netflix and video game stocks, as was the small real estate sector. The week closed out the best quarters for DJIA and S&P since 1987 and 1998, respectively. Markets were closed Friday in advance of the 4th of July holiday.

Oil Sector Performance

Crude prices strengthened after better than expected economic data suggested most economies were rebounding quickly following the easing of lockdowns across several countries.

Market-Moving News

Resurgent Stocks

U.S. stocks recovered all the ground lost in the previous week’s decline. In a 4-day trading week, each of the three major indexes posted a weekly gain exceeding 3%; with NASDAQ led the way with a nearly 5% rise.

Gold's Rose

Gold prices rose 13% in the second quarter, their biggest quarterly gain in four years. On Tuesday, gold closed above $1,800 per ounce for the first time since 2011, and prices moved within 5% of their record high set that year.

Mixed Employment Report

June’s U.S. jobs report produced better-than-expected numbers, including 4.8 million jobs added and an unemployment rate of 11.1%. However, the results reflected a snapshot of the labour market at mid-month, and economists believe that hiring weakened in late June as new coronavirus cases spiked and many states reinstated public health precautions.

Bullish Quarter

20.5% return that the S&P 500 posted in the second quarter was the index’s best quarterly result since 1998, while Dow’s 18.5% return was that index’s biggest since 1987. For the S&P 500, the last three months produced a near-complete turnaround from the first quarter, leaving the index with a -3.1% return for the first half of the year.

Other Important Macro Data and Events

Equities jumped, bond yields climbed, and crude oil prices strengthened after better than expected economic data suggested most economies were rebounding quickly following the easing of lockdowns across several countries.

Hopes for a faster recovery however, overshadowed concerns of an increase in coronavirus cases, and warnings from the WHO and U.S. Federal Reserve that challenging times could still be ahead.

Signs of an economic rebound extended to Europe and Asia. France and Germany saw record surges in consumer spending and retail sales. Manufacturing PMIs for June were revised higher in Germany, France, and Italy. Most major stock markets in Europe saw gains. Better than expected industrial profits and manufacturing indices in China lifted most Asian markets. This included Hong Kong, despite the US suspension of preferential treatment for the territory after China passed its new national security law and began implementing it July 1.

U.S. Treasuries finished mixed for the week. The 2-yr yield declined one basis point to 0.15%, while the 10-yr yield increased three basis points to 0.68%. The U.S. Dollar Index declined 0.2% to 97.22.

What We Can Expect from the Market this Week

The increase in global COVID-19 infection rates has dented momentum across markets despite the improvements in the global economy, which continues to beat most data expectations.

Important economic news coming out next week includes the Markit PMI Composite index, domestic auto sales and Consumer Credit data.