PAST WEEK'S NEWS (AUGUST 14 – AUGUST 18, 2023)

Country Garden, formerly the largest real estate developer in China by sales, is teetering on the brink of default after missing bond payments. Its shares plunged to record lows as numerous bonds were suspended from trading, sparking contagion fears. With sales plummeting 34% amid the property downturn and hefty debt payments looming, the once-mighty Country Garden seems unable to avoid default. While not as impactful as Evergrande's implosion, a Country Garden collapse could deal a further blow to already shattered confidence in private developers. It could also have ripple effects given banks' significant exposure to mortgages and construction loans in the property sector. The case signals a deepening turmoil in China's real estate market despite government efforts to instil stability.

The FOMC minutes revealed divided views among policymakers about further interest rate hikes. Most officials saw upside risks to inflation and felt further tightening may be needed, while some cited concerns about economic risks if rates rise too high or remain higher for longer. The minutes indicated growing caution about rate hikes given uncertainty about the inflation outlook. Several policymakers advocated leaving rates unchanged in July. The minutes suggest a more patient approach to rate hikes going forward as the Fed watches incoming data on the disinflation process, which may have ended after the Consumer Price Index (CPI) rebounded to 3.2% last week.

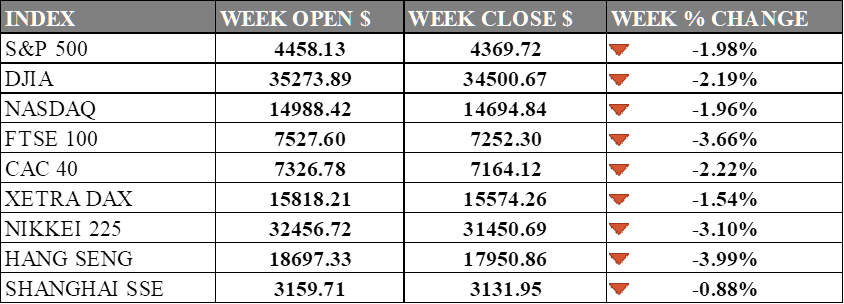

INDICES PERFORMANCE

The S&P 500 index closed 1.98% lower for the week ending August 18, 2023 at 4369.72. The index opened the week at 4458.13 but slid lower as investors are confronting the possibility that the Federal Reserve will maintain high interest rates over an extended period. Similarly, the Dow Jones Industrial Average (DJIA) dropped 2.19% week-over-week to close at 34500.67. The 30-stock index started the week at 35273.89 but failed to sustain momentum due to sell-off in banking sector stocks, coupled with strong retail sales data that reinforced concerns about persistently high interest rates, weighed on the Dow Jones Industrial Average. The tech-heavy NASDAQ composite fell 1.96% for the week to finish at 14694.84. The index began trading at 14988.42 on Monday but faced selling pressure throughout the week due to due to a Fitch downgrade that ignited a selloff.

Across the Atlantic, the UK's FTSE 100 index was hit the hardest, tumbling 3.66% to end at 7252.30 compared to 7527.60 last Friday. The increased volatility came due to a combination of factors, including global risk sentiment, interest rate fears, and a drop in UK retail sales. France's CAC 40 and Germany's XETRA DAX saw more modest declines of 2.22% and 1.54% respectively. The CAC 40 closed at 7164.12 while the DAX settled at 15574.26. The European indices were weighed down by mounting apprehension surrounding China's economic prospects coupled with fears of additional interest rate hikes and the possibility of recessions in the UK and eurozone..

In Asia, Japan's Nikkei 225 dropped 3.10% week-over-week, closing at 31450.69 after opening at 32456.72 on Monday. Hong Kong's Hang Seng index plunged 3.99% for the week to end at 17950.86. The losses came as Hong Kong slumped as China's economy weakened, evidenced by falling manufacturing output and lack of stimulus despite the flagging recovery. Muted trading early in the week could also been due to investors preparing for the annual Russell index rebalancing, while concerns over further Fed rate hikes also weighed on sentiment. China’s Shanghai Composite fared better than its regional peers, falling just 0.88%.

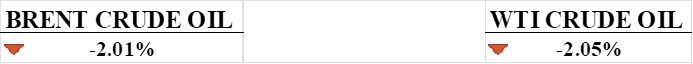

CRUDE OIL PERFORMANCE

After seven weeks of gains, oil prices dropped this past week due to concerns about economic troubles in China, surprise increases in US production, and upcoming supply cuts by Saudi Arabia and Russia. Technical indicators suggest oil prices may continue declining in the coming week amid questionable summer fuel demand and optics, though the cuts by Saudi and Russia could remove almost 68 million barrels over 45 days. Market expectations are mixed given uncertainties around the impact of lower economic activity in China, higher US output, and the Saudi-Russian supply reductions, though bearish views on China and weakening technical momentum seem dominant for now. Prices may test support around $78 if they break below the 50-week moving average, with resistance seen between $85-87 from the 100-week average and monthly Bollinger Bands.

OTHER IMPORTANT MACRO DATA AND EVENTS

Malaysia's economic growth hit a nearly 2-year low in Q2 due to sliding exports and global slowdown, prompting the central bank to warn full-year growth will be at the lower end of its forecast. The weak outlook is unlikely to change expectations that the central bank will keep policy rates on hold this year amid slowing global demand and trade.

US mortgage rates jumped this week, with the 30-year fixed rate hitting its highest level since 2002, further complicating the housing market as affordability declines though inventory remains low. The surge in rates to over 7% could temper recent building trends, keeping supply tight and prices high as demand is impacted by rising borrowing costs.

Bankruptcy declarations in the EU reached the highest level since 2015 in Q2 2022, driven by increases in accommodation, food services, transportation, and storage sectors, according to Eurostat data. While registrations of new businesses edged down in the same period, they remained higher than 2015-2022 levels, with bankruptcies now exceeding pre-pandemic levels in most sectors except industry and construction.

What Can We Expect from The Market This Week

German PPI: The German Producer Price Index (PPI) measures the average change in the price of goods sold by manufacturers and producers in the wholesale market. The expected PPI is -0.2%, compared to -0.3% last month.

US New/Existing Home Sales: Existing home sales in the US, which include completed transactions of single-family homes, town homes, condominiums, and co-ops, fell 3.3% to a seasonally adjusted annual rate of 4.16 million in June 2023 and are expected to reach 4.15 million in July.

US Building Permits: Privately owned housing units authorised by building permits in July 2023 were at a seasonally adjusted annual rate of 1,442,000, which is 0.1% above the revised June rate but still 13% below the July 2022 rate of 1,658,000. Single-family authorizations in July came in at a rate of 930,000, which is 0.6% above the revised June figure of 924,000. Multi-family authorizations of units in buildings with five units or more were at a rate of 464,000 in July.

US Durable Goods Order: New orders for US manufactured durable goods jumped 4.7% month-over-month in June 2023, beating market expectations of a 1% increase. It marks the fourth straight month of rising durable goods orders.

German GDP Q2: The German economy is expected to stagnate in the second quarter of 2023, missing forecasts for modest growth as weak purchasing power, higher interest rates, and low factory order books all weigh on the euro zone's largest economy.