PAST WEEK'S NEWS (August 10 – August 16, 2020)

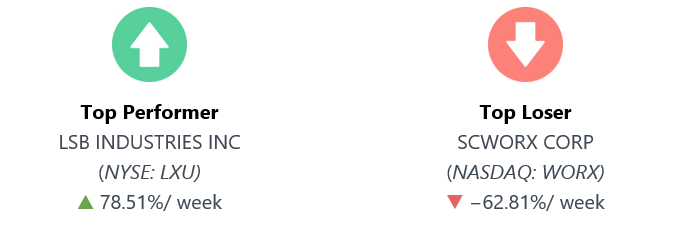

Stocks Performance (U.S. Stocks)

Most stock markets around the world moved higher last week as economic data continued to improve and daily new cases of COVID-19 and hospitalizations fell in the US, especially in New York and California. After US President Donald Trump said that he’s considering a capital gains tax cut, along with weekly claims for unemployment benefits dropping below one million for the first time since the pandemic began, the S&P 500 briefly surpassed its previous all-time high, reached in February.

The growing confidence was also bolstered by much better-than-anticipated Q2 corporate earnings reports. Although earnings have mostly been very weak on an absolute basis, the COVID-19 slowdown seems to have depressed expectations too much. With most companies having now reported, more than 80% beat earnings estimates and almost two thirds posted better than expected revenue growth.

Markets also seemingly got a brief boost after Russia announced it had approved a “Sputnik” coronavirus vaccine, though enthusiasm appeared to wane after many experts cautioned that it was being released without extensive testing. Shares in Boeing (NYSE: BA) rose early in the week after the Transportation Security Administration reported that 830,000 passengers had boarded commercial airplanes on Sunday, the biggest daily number since the pandemic took hold in March. Tesla (NASDAQ: TSLA) surged 20% in three days after announcing a 5:1 stock split on Tuesday.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at 5.38%, followed by Transportation at 3.65%, Producer Manufacturing at 3.30%, Process Industries at 2.60%, and Communications (2.41%). Meanwhile, the weakest sectors were from the Technology Services sector (-1.31%), Utilities (-1.04%), Non-Energy Minerals (-0.84%), and Miscellaneous sector (-0.68%).

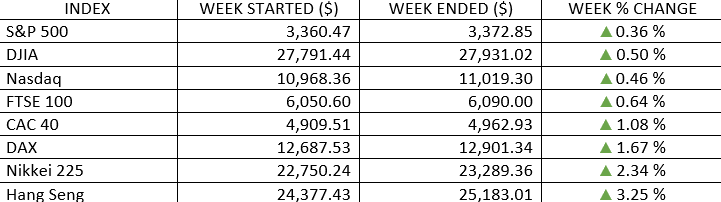

Indices Performance

In the S&P 500, the industrials sector led the advance, as data showed industrial production and capacity utilization increased in July for the third straight month.

European equity markets continued to move higher in the wake of last week’s PMI, which showed the area’s manufacturing sector expanded for the first time in a year and a half. Though, stock gains were tempered Friday after the UK government added France and several other countries to its list of countries from which arriving people must quarantine for two weeks. The move intensified concerns of a second wave of COVID-19 in Europe.

Most Asian markets were higher, with Japan especially strong. In a holiday-shortened trading week, the Nikkei 225 jumped after a survey of Chinese manufacturing showed a solid expansion in July. However, stocks in China itself, measured by the Shanghai Composite Index, barely scraped out a small gain as US-China tensions continued to ratchet higher.

Oil Sector Performance

Rising economic optimism lifted oil prices to a five-month high and boosted global government bond yields.

Market-Moving News

Gold Pulls Back

After surging above $2,000 per ounce in the previous week, the price of gold retreated from that record level to around $1,950. Nevertheless, it’s been a strong run for gold, which was trading below $1,500 as recently as March. In mid-July, it was at around $1,800.

Signs of Recovery

U.S. retail sales rose 1.2% in July, marking the third consecutive monthly gain, as shopping surpassed pre-pandemic levels. In the labor market, 963,000 unemployment claims were filed in the latest weekly count, ending a string of 20 consecutive weeks in which claims topped 1 million.

Washington-Beijing Talks

As the week ended, U.S. and Chinese officials opened a new round of trade talks in the wake of rising tensions that have put investors on edge. Among other things, the two economic superpowers planned to evaluate China’s initial compliance with a bilateral trade agreement signed in January.

On the Cusp

The S&P 500 on Wednesday closed within a tenth of a percentage point of its record high set six months earlier, but the index couldn’t quite climb above its prior peak of 3,386 points. At Friday's close, it remained about 0.4% below the record.

Europe Stalls

European stock indexes fell on Friday after the U.K. imposed a quarantine on travellers from France. Separately, the U.K. reported that Q2 GDP plunged more than 20%.

Bond Sell-Off

After sinking as low as 0.55% in the previous week, the yield of the 10-year U.S. Treasury bond topped 0.70% on Thursday for the first time in nearly two months. U.S. government bonds came under selling pressure after a $38 billion auction of new 10-year notes.

Other Important Macro Data and Events

Markets got a brief boost after Russia announced it had approved a “Sputnik” coronavirus vaccine, but enthusiasm appeared to wane after many experts cautioned that it was being released without extensive testing.

U.S. President Donald Trump issued an executive order Friday forcing China’s ByteDance to sell or spin off its U.S. TikTok business within 90 days.

Rising economic optimism lifted oil prices to a five-month high and boosted global government bond yields. Gold prices, which had only last week climbed above US $2,000 per ounce for the first time, retreated sharply as investors sold “safe havens”.

The U.S. Treasury curve steepened noticeably this week amid a sell-off in longer-dated maturities. The 10-yr yield rose 15 basis points to 0.71%, while the 2-yr yield was unchanged at 0.13%. The U.S. Dollar Index declined 0.3% to 93.10.

What We Can Expect from the Market this Week

With the majority of Q2 earnings behind the market, investors will turn to economic data for the latest indications on the economy.

Important economic news coming out this week including housing market index on Monday, housing starts on Tuesday, FOMC minutes on Wednesday, weekly unemployment claims on Thursday, and existing home sales on Friday.