PAST WEEK'S NEWS (November 18 – November 22, 2024)

Wall Street veteran Howard Lutnick, who was in the run for treasury Secretary, just confirmed to instead become America's next Commerce Secretary under President-elect Trump, bringing his extensive financial market experience to oversee the nation's critical trade relationships and technology controls. The Cantor Fitzgerald CEO's appointment implies a somewhat aggressive shift in U.S.-China trade policy, with Trump's team contemplating tariffs as high as 60% on Chinese imports—though Reuter's poll expects a more moderate 38% rate due to its immediate inflationary effect. Lutnick, who rarely speaks publicly about China despite his firm's involvement in Chinese IPOs, has endorsed an assertive tariff strategy, suggesting it could generate $400 billion while advancing Trump's "America First" agenda. The Commerce Department's expanding role in restricting sensitive technology exports, particularly in semiconductors and AI, positions Lutnick at the centre of America's economic competition with China. Economists surveyed by Reuters predict these new trade measures could slice up to one percentage point off China's GDP growth, further pressuring Beijing to consider additional stimulus measures.

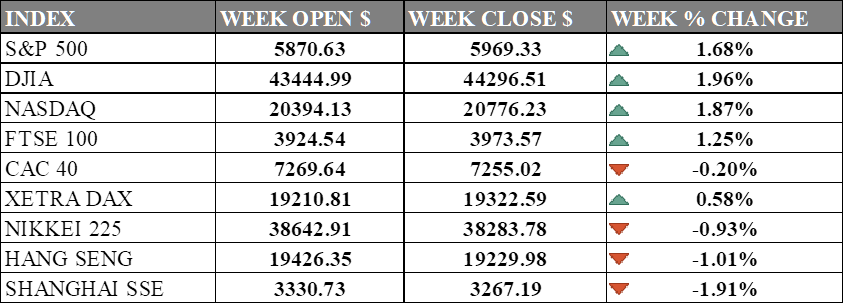

INDICES PERFORMANCE

Wall Street ended in a broadly positive week across major indices. The S&P 500 gained 1.68% to close at 5,969.33. The Dow Jones Industrial Average advanced 1.96%, finishing at 44,296.51, while the tech-heavy Nasdaq showed strong performance with a 1.87% increase to close at 20,776.23. The market gains reflect growing investor optimism in the cyclical sector instead of tech, with ongoing discussions about the timing of potential interest rate cuts by the Federal Reserve.

European markets were mixed although broadly fare better. The UK's FTSE 100 gained 1.25%, closing at 3,973.57. France's CAC 40 saw a slight decline of 0.20%, closing at 7,255.02. Germany's XETRA DAX showed modest gains, rising 0.58% to end at 19,322.59. The varied performance in European markets suggests regional differences in economic outlook and investor sentiment.

Asian markets performed worse than their west counterpart. Japan's Nikkei 225 declined 0.93% to close at 38,283.78, diverging from the positive performance in American markets. Chinese markets also showed weakness, with Hong Kong's Hang Seng Index falling 1.01% to close at 19,229.98. The Shanghai Composite in mainland China posted the largest regional decline, dropping 1.91% to 3,267.19. The weakness in Asian markets continues to reflect concerns about China's economic recovery and regional growth prospects.

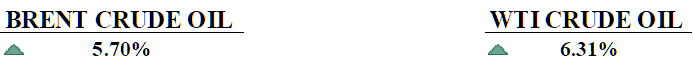

CRUDE OIL PERFORMANCE

Oil markets are entering a complex phase as Citi Research simulates a potential inflation to $120 per barrel, while current prices hover around $75 even with escalating geopolitical tensions in Ukraine and the Middle East. A hypothetical price spike of this magnitude could trim global economic output by 0.4% and trigger a two-percentage-point jump in worldwide inflation, though the United States might weather the storm better than Europe or China thanks to its domestic oil production. Natural gas markets paint a more optimistic picture for 2025, with Bank of America projecting Henry Hub prices to average $3.33/MMBtu, with growing LNG exports and weather-related demand spikes. The energy landscape is further complicated by China's aggressive policy measures to boost energy imports and India's increasing crude consumption, while Europe grapples with deteriorating business activity.

OTHER IMPORTANT MACRO DATA AND EVENTS

Germany GDP reports came out and show that its economy only grow by 0.1% in Q3 this year, revised from 0.2%. Exports suffered while investment into its economy declined, prompting analyst to signal an impending recession even with gains in household and government spending.

Japan's core inflation stayed above 2% in October, with figures rising faster when fuel is excluded, and services inflation also picking up due to higher wages. This has raised expectations that the Bank of Japan might hike rates in December, especially with the yen weakening.

What Can We Expect from The Market This Week

PCE Price Index: Personal consumption index increased by 2.1% year-on-year in September, down from 2.3% in August, while the core price index was at 2.65%. Analysts expect inflation rates to continue declining, projecting a year-end rate of 2.1% for 2024 and further declines in subsequent years.

FOMC Meeting Minutes: The FOMC recently cut the federal funds rate by 25 basis points to a target range of 4.50% - 4.75%, its second step in its monetary easing journey after projecting lower inflation and a strong labour market. Clues are desperately sought after considering the market is now almost 50/50 on the next rate decision, between a cut and a pause.

Eurozone CPI: Prices in Eurozone rose to 2.0% annually, with slower declines in energy prices and increased costs in food and services. The core inflation rate remained stable at 2.7%, proving ongoing inflationary pressures against overall moderation.

RBNZ Interest Rate Decision: New Zealand is expected to lower the official cash rate by 50 basis points to 4.25% in its upcoming meeting after its lowered inflation pressures and economic challenges. This decision follows a previous cut in October and aims to support economic stability while maintaining inflation within the target range of 1-3%.

China Manufacturing PMI: China's manufacturing sector showed signs of recovery, with the NBS Manufacturing PMI rising to 50.1 and the Caixin Manufacturing PMI increasing to 50.3, escaping several months of contraction into expansion. It's thanks to increased output and stabilization in new orders, although there are growing challenges in foreign sales.