PAST WEEK'S NEWS (January 06 – January 10)

The majority of large banks now think the Fed will keep trimming its balance sheet through June, longer than first thought. The Fed has already cut its holdings from $9 trillion to $7 trillion as it tries to normalise market conditions without causing a crash, but things got trickier in late 2024 when some banks had to use the Fed's emergency cash window, showing signs of market stress. The Fed's December meeting minutes revealed growing inflation worries, leading officials to plan fewer rate cuts in 2025. They now see just two cuts coming, down from their earlier forecast of four. Trump's return to the White House adds another layer of uncertainty, with his trade and immigration policies likely to shake up the Fed's plans.

Elon Musk's growing political influence and involvement raise concerns about oligarchic control, where a few wealthy individuals could exert disproportionate influence over society and governance. His net worth has skyrocketed since Trump's re-election, nearing $300 billion as Tesla shares climb higher. The tech billionaire's increasingly public role in European politics and his new position co-leading Trump's Department of Government Efficiency have some market watchers wondering how his political activities might affect Tesla's business relationships, especially in Europe. His recent criticism of European leaders and support for far-right parties has already prompted the EU to consider expanding its investigation into X, his wholly-owned social media platform. A controversial figure like Andrew Tate had also join the UK political scene through his quirky named party, Votebruv. A new age of politics is actively emerging to suit the new generation's preferences and proximity, with populist billionaires at its head.

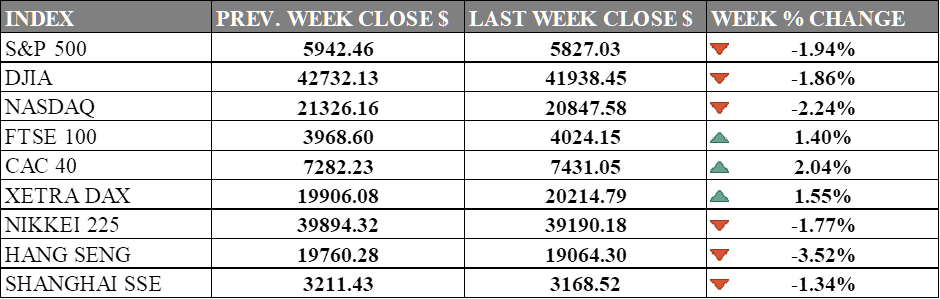

INDICES PERFORMANCE

Wall Street ended the week with declines across major indices. The S&P 500 dropped 1.94% to close at 5,827.03. The Dow Jones Industrial Average (DJIA) fell 1.86%, finishing at 41,938.45, while the Nasdaq also saw a significant decline, dropping 2.24% to close at 20,847.58. Concerns over inflation and potential Fed rate cuts have made investors cautious. Despite strong fundamentals like low unemployment and cooling inflation, markets remain sensitive to policy shifts under the Trump administration, especially on tariffs and immigration, which could add volatility.

European markets had a more positive week overall. The UK's FTSE 100 rose 1.40%, closing at 4,024.15. France's CAC 40 saw a strong gain, increasing 2.04% to close at 7,431.05. Germany's XETRA DAX also climbed, rising 1.55% to end at 20,214.79. The performance reflects cautious optimism amid economic challenges, including weak manufacturing and political uncertainties in France and Germany. Concerns over Trump’s trade policies affecting European exports persist, but anticipated ECB rate cuts in 2025 offer optimism, especially for rate-sensitive sectors like real estate and consumer industries.

Asian markets faced a broadly negative week. Japan's Nikkei 225 declined 1.77% to close at 39,190.18, reflecting market weakness despite recent tech gains in the U.S. market. Chinese markets were also down, with Hong Kong's Hang Seng Index dropping 3.52% to close at 19,064.30. The Shanghai Composite in mainland China saw a decline, falling 1.34% to 3,168.52. Trump's proposed tariff hikes weighed on export-dependent economies, but South Korea's Kospi rose 1.91%, driven by tech stock gains, reflecting regional divergence.

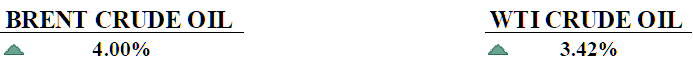

CRUDE OIL PERFORMANCE

Oil markets got a wake-up call this Monday as prices shot up nearly 2%, pushing Brent crude past $81 and WTI to $77 a barrel after a 4% bump up in prices last week. The jump came after the Biden administration rolled out its toughest sanctions yet on Russian oil, targeting major producers like Gazprom Neft along with 183 vessels involved in shipping Russian crude. These sanctions are already shaking up global oil flows, as top buyers India and China might need to look elsewhere for their oil supplies, potentially turning to sellers in the Middle East, Africa, and the Americas. The weather is adding extra pressure to prices too, with cold snaps across the US and Europe driving up demand for heating fuel. Looking ahead to 2025, investment firm Raymond James thinks oil prices will hover around $70 per barrel for WTI crude, which is a bit higher than what futures markets are betting on right now. The timing of these sanctions is particularly interesting, as they're meant to give the incoming Trump administration more leverage in future negotiations with Russia about the war in Ukraine.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. job growth surged by 256,000 in December, lowering unemployment to 4.1% and showcasing a resilient labor market. The strong report supports expectations that the Fed will hold interest rates steady.

Euro zone inflation rose to 2.4% in December due to higher energy and services costs but is expected to decline toward the ECB's 2% target this year. The ECB plans further rate cuts, though sticky core inflation and economic uncertainties temper expectations.

What Can We Expect from The Market This Week

US CPI December: consumer inflation stands at 2.7% and is projected to be 2.9% for December, with core inflation at 3.3%, suggesting ongoing price pressures. The Federal Reserve is expected to maintain a cautious stance on interest rates, with only two anticipated cuts this year.

German CPI December: Prices in Germany rose to 2.6% in December preliminary data, with slower declines in energy prices, higher food costs, and accelerating services inflation. This changes Germany's economic outlook, as the country faces stagnant growth and a strained labour market heading into 2025.

China GDP Q4: China’s economy grew by 3.1% for the year 2024, excluding incoming Q4 data, caused by strong exports, manufacturing recovery, and government stimulus, but persistent threats like a weak property sector, subdued domestic demand, and geopolitical risks cloud the 2025 outlook, with growth projected at 4.5%-4.9%. Policymakers face the dual task of sustaining short-term momentum through fiscal initiatives while addressing long-term structural reforms to stabilise the economy.

US Retail Sales: Retail saw strong growth in e-commerce and pharmacy sectors offset by declining traditional retail sales, as inflation and higher interest rates pressure consumer spending. Retailers are adapting through AI-driven innovations, supply chain optimisations, and sustainability efforts, but the sector remains vulnerable to ongoing economic risk and shifting consumer preferences.

Philadelphia Fed Manufacturing Index: a key indicator of regional manufacturing activity, showed contraction in late 2024 and early 2025, facing challenges like weak demand, rising labour costs, and regulatory uncertainty. Despite these setbacks, manufacturers remain cautiously optimistic about future growth, with expectations of a gradual recovery in 2025.