PAST WEEK'S NEWS (January 27 – January 31)

The AI world got a wake-up call on Monday when Chinese startup DeepSeek sent tech stocks into a spiral, triggering the biggest one-day drop in Nvidia's history, wiping out $593 billion in market value. The news hit hard because DeepSeek claims it built its AI model for just $5.5 million using cheaper chips and less data, raising real questions about the sky-high valuations of U.S. tech companies that have been pushing for AI-related industries. The selloff went well beyond just chipmakers, hitting everything connected to AI—from data centre operators to power companies that were counting on huge energy demand from AI computing. The timing couldn't be more dramatic, with tech heavyweights Microsoft, Meta, and Tesla all set to report earnings this week, leaving investors wondering if this Chinese AI challenger might force U.S. companies to rethink their expensive AI plans.

The trade market just got a lot more interesting after President Trump's decision to impose tariffs on China, Mexico, and Canada sent shockwaves through the financial world. Investors are now bracing for potential ripple effects, as these tariffs could make everything from cars to electronics more expensive for consumers. Japan’s automakers, like Toyota and Honda, saw their stock prices take a hit because they rely heavily on supply chains in North America that might now face higher costs. Meanwhile, China isn’t backing down either, vowing to challenge the tariffs at the World Trade Organization while warning of countermeasures that could escalate tensions further. With Canada and Mexico retaliating by slapping tariffs on U.S. goods, industries like agriculture and manufacturing could feel the pinch if demand shifts away from American products. While all this back-and-forth makes for dramatic headlines, everyday investors should keep an eye on how long these trade disputes last—prolonged uncertainty could slow economic growth and leave markets jittery for months to come.

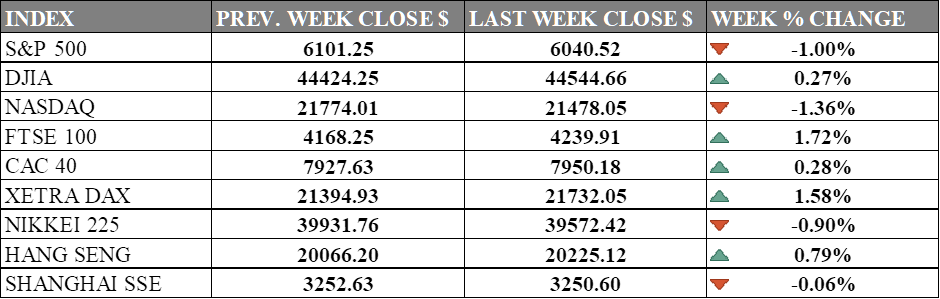

INDICES PERFORMANCE

Wall Street ended the week with mixed performances across major indices. The S&P 500 experienced a decline of 1.00%, closing at 6,040.52, despite forward earnings growth being a key factor in previous rallies. The Dow showed a slight increase of 0.27%, finishing at 44,544.66, supported by favourable economic indicators and strong earnings from its sectors. Meanwhile, the Nasdaq posted a more significant decrease of 1.36%, closing at 21,478.05, as concerns over emerging competition from Chinese AI companies like DeepSeek posed risks to the tech-heavy index.

European markets demonstrated varying degrees of performance. The UK's FTSE 100 gained 1.72%, closing at 4,239.91, driven by corporate developments and broader economic conditions. France's CAC 40 saw a modest rise of 0.28%, ending at 7,950.18, while Germany's XETRA DAX advanced by 1.58%, closing at 21,732.05. These gains were underpinned by projections of a potentially lower interest rate environment that could support future growth.

Asian markets also showed mixed results. Japan's Nikkei 225 declined by 0.90%, closing at 39,572.42, despite earlier support from the Bank of Japan’s decision to adjust interest rates. Hong Kong's Hang Seng Index rose by 0.79%, finishing at 20,225.12, buoyed by gains in technology and financial sectors. In mainland China, the Shanghai Composite Index edged down slightly by 0.06%, ending at 3,250.60, reflecting cautious investor sentiment amid ongoing market dynamics especially the intensity of trade war ongoing with the United States.

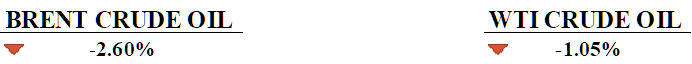

CRUDE OIL PERFORMANCE

As U.S. President Trump announced new tariffs on Canadian and Mexican oil, the oil market got a bit rocky over the weekend. With tariffs set to hit at 25% for Mexico and 10% for Canada, U.S. refiners are bracing for higher costs, especially in the Midwest, where many rely heavily on Canadian crude. This means American consumers could see gas prices tick up, hitting wallets harder as refiners pass on those higher expenses. Meanwhile, European and Asian refineries stand to benefit, gaining a competitive edge as U.S. rivals struggle with less profitable operations. The move complicates things for U.S. refineries, who aren’t easily able to switch to lighter domestic crude due to their specialized setups. Overall, while some players win, others lose, and it’s the everyday driver who might end up footing the bill for this trade tussle.

OTHER IMPORTANT MACRO DATA AND EVENTS

In December, the PCE price index increased by 0.3% month-on-month (2.6% annually) with core inflation steady at 2.8%. Meanwhile, consumer spending rose by 0.7% as a strong labour market and wage growth boosted activity.

The U.S. economy grew 2.3% in Q4 2024, down from 3.1% in Q3, staying resilient due to strong consumer demand and a resilient jobs market despite disruptions. The Fed kept rates at 4.25%-4.5%, though potential policy shifts under President Trump may delay future rate cuts.

What Can We Expect from The Market This Week

BoE Interest Rate Decision: The Bank of England's base interest rate currently stands at 4.75%, following a 25 basis point cut in November 2024. The current consensus around the February 6th meeting is another 25 bps cut to 4.50% as the inflation rate stayed within range while domestic growth stagnated..

JOLTs Job Openings: Job openings in the U.S. were a little higher at 8.1 million on the last business day of November. Although lower by 827,000 compared to last year, it could be an early sign of a trend reversal, breaking out of the decline.

Eurozone CPI January: Eurozone January preliminary inflation data is estimated to flat out at 2.4% after December saw it rise from 2.2% to 2.4%, reducing hopes for further cuts by the ECB. The data could come lower as Germany's preliminary inflation data was lower than expected.

OPEC Meeting: OPEC+ will hold a Joint Ministerial Monitoring Committee (JMMC) meeting to assess member compliance with voluntary production cuts of 2.2 million bpd, though much of these cuts were already in effect. OPEC+ faces challenges from Angola's recent exit and record-high U.S. shale production, which could impact its efforts to stabilise the market.

ISM Non-Manufacturing PMI: The ISM Services PMI rose to 54.1 in December 2024 from 52.1 in November, surpassing market expectations of 53.3 and marking the 10th consecutive month of expansion in the U.S. services sector. This continued growth in the service industries was attributed to strong demand, employment trends, and higher business activity.