PAST WEEK'S NEWS (February 10 – February 14)

Inflation proved to be still running hot, and it’s not going away anytime soon. The latest CPI report showed headline inflation ticking up to 3.0% and core inflation hitting 3.3%, thanks to rising rents, food prices (up 0.4%), and infamously, egg prices that have seen a price tag 53% higher over the past year. On top of that, producer prices also came in higher than expected, with the PPI rising 0.4% last month; businesses are feeling the pinch. This all but kills hopes for an early Fed rate cut to compound with Fed Chair Jerome Powell, who made it clear they’re in no rush to lower rates if inflation stays above their 2% target. Markets now think the earliest we’ll see a cut is September, not considering the ongoing tariffs plan that could spike inflation figures, making the Fed’s job even more complex.

More people in D.C. are searching for 'criminal defence lawyer' than in any other state, and while that might sound dramatic, it’s just one of the many side effects of President Trump and Elon Musk’s bold push to shrink the federal workforce that not only costs the taxpayer but might also be riddled with corruption. With unemployment in the nation’s capital nearly doubling since Trump’s hiring freeze and Musk’s efficiency crusade, the ripple effects are starting to show—not just in job losses but in the local economy. For every federal worker who loses their job, experts estimate 2.3 private sector roles could vanish too, leaving businesses that rely on government spending scrambling to adapt. Critics argue this rapid downsizing risks wiping out decades of institutional knowledge, while supporters see it as a long-overdue shake-up of bloated bureaucracy. Although legal battles and union pushback slow the momentum, the big question remains as to the ability for D.C. to pivot to industries like tech and healthcare fast enough to cushion the blow.

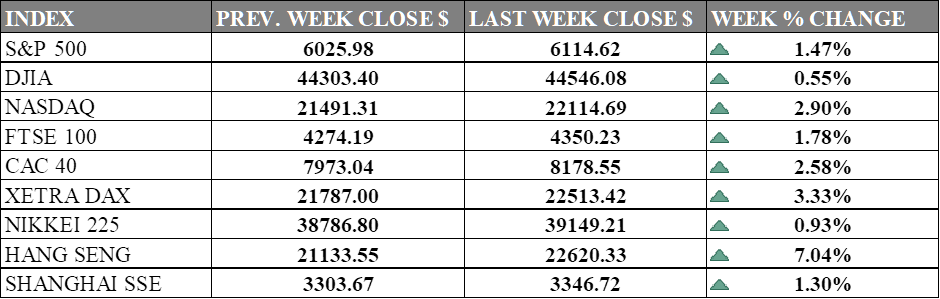

INDICES PERFORMANCE

Wall Street ended the week with positive performances across major indices. The S&P 500 rose by 1.47%, closing at 6,114.62, driven by forward earnings growth and market optimism. The Dow Jones Industrial Average (DJIA) increased by 0.55%, finishing at 44,546.08, despite broader market uncertainties. Meanwhile, the Nasdaq posted a significant gain of 2.90%, closing at 22,114.69, as the tech-heavy index benefited from strong performances in the technology sector. The shift from small cap to mega cap shows that macro factor are at play during the week namely growing consumer inflation that usually drives up overall value of market capitalization.

European markets performed better than its U.S. counterpart. The UK's FTSE 100 gained 1.78%, closing at 4,350.23, supported by corporate developments and broader economic conditions. France's CAC 40 saw a notable rise of 2.58%, ending at 8,178.55, while Germany's XETRA DAX advanced by 3.33%, closing at 22,513.42. These gains were underpinned by expectations of a potentially lower interest rate environment that could support future growth.

Asian markets showed mixed results. Japan's Nikkei 225 increased by 0.93%, closing at 39,149.21, reflecting its strong economic growth data. Hong Kong's Hang Seng Index surged by 7.04%, finishing at 22,620.33, owing to the US's more reserved stance on reciprocal tariffs and sustained enthusiasm for Chinese tech companies. In mainland China, the Shanghai Composite Index rose by 1.30%, ending at 3,346.72, supported by policy measures aimed at stabilizing the market amid ongoing trade tensions with the United States.

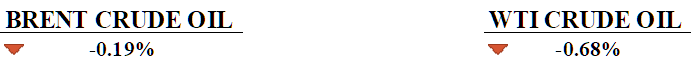

CRUDE OIL PERFORMANCE

It’s a volatile week in the crude oil market as traders reacted to U.S. President Donald Trump's promise to end Russia's war on Ukraine offset gains from his threats of widespread tariffs on trading partners although it fell short of what is expected. Market participants are assessing the potential return of Russian supplies amid peace talks between Trump, Putin, and Zelenskiy, which could ease supply concerns if sanctions on Moscow are lifted. The delay in implementing reciprocal U.S. tariffs provided some stability, as investors remain hopeful for new trade agreements before the April 1 deadline. Meanwhile, global oil demand reached 103.4 million barrels per day, supported by rising consumption of mobility and heating fuels, according to JPMorgan analysts.

OTHER IMPORTANT MACRO DATA AND EVENTS

Japan’s Q4 GDP grew by 0.7% quarter-on-quarter and 2.8% year-on-year, with strong exports and capital spending. The boost came as businesses pre-emptively increased exports amid looming U.S. tariffs, with the Bank of Japan’s rate hike and expected wage growth supporting future consumer spending.

Retail sales fell 0.9%—well beyond the expected 0.2% drop—reversing previous growth and suggesting economic uncertainty that could slow growth and weigh on the USD.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The Reserve Bank of Australia is expected to cut interest rates for the first time in four years thanks to easing inflation and concerns about undershooting the inflation target band. Experts predict this will boost confidence among home buyers and sellers, impacting property prices and mortgage payments while economic growth staying healthy with IMF targeting 2.1% for 2025.

RBNZ Interest Rate Decision: The Reserve Bank of New Zealand is expected to deliver a 50 basis-point rate cut to 3.75%, induced by controlled inflation (2.2% within target) and weak economic growth compiled with rising unemployment (5.1%). While this marks the third consecutive aggressive cut since August 2024, future easing is likely to slow as policymakers balance recession risks against global trade and manufacturing recovery.

UK CPI January: Consumer Inflation in the United Kingdom are currently standing at 2.5% and projected to rise to 3.7% by Q3 2025 with regard to elevated energy costs, regulated price adjustments, and persistent services inflation, before moderating toward the 2% target as monetary policy remains restrictive.

US Philly Fed Manufacturing Index: The Index saw it climb to 44.3 in January 2025, its highest level since April 2021, attributed to increases in new orders and shipments. However, rising input costs and elevated output price pressures suggest inflationary risks, though firms remain optimistic about growth prospects over the next six months as future activity indicators improved.

UK Retail Sales: Figures showed a 2.6% year-on-year growth, fueled by post-holiday discounts and improved consumer sentiment as inflation eased to 2.5% and real wages grew . However, national Insurance hikes, a higher minimum wage, and business rate reforms may pressure margins and future growth.