PAST WEEK'S NEWS (February 17 – February 21)

Japan's inflation hit a two-year high of 4.0% annually in January, 0.4% higher from last month and climbing fast. The sudden increase is blamed on consumer spending and increasing food prices, which would become the base for more interest rate hikes by the Bank of Japan (BOJ). The core CPI, excluding fresh food, climbed to 3.2%, exceeding forecasts, while the "core-core" CPI, which also leaves out energy, reached 2.5%, significantly above the BOJ’s 2% target. This inflationary trend has been intentionally triggered by forced wage growth and a reduction in the anti-inflationary impact of government subsidies, strengthening the argument for tighter monetary policy. Although manufacturing activity has contracted for the eighth month in a row due to labour shortages and inflation, the services sector has shown proper resilience, contributing to overall economic strength. The BOJ is now under increasing pressure to tackle inflation risks and the depreciation of the yen, with Governor Kazuo Ueda indicating a willingness to adjust monetary policy as necessary.

President Trump recently announced his intentions to impose a 25% tariff on auto imports, alongside significant duties on semiconductors and pharmaceuticals. These threats aim to address what Trump perceives as ongoing unfair trade practices, particularly the disparity between EU and U.S. automotive tariffs. The proposed tariffs could disrupt the auto industry, which is already in a mess from previous tariff threats. Although similar actions were considered in 2018-2019 but ultimately shelved, updated investigations may inform new and effective tariff implementations. Meanwhile, EU trade officials are engaging with U.S. partners to mitigate reciprocal tariffs, even with denials of prior agreements to lower EU tariffs. Trump believes the move will increase U.S. investments from major global companies as businesses adjust to avoid impending tariffs by establishing domestic production facilities.

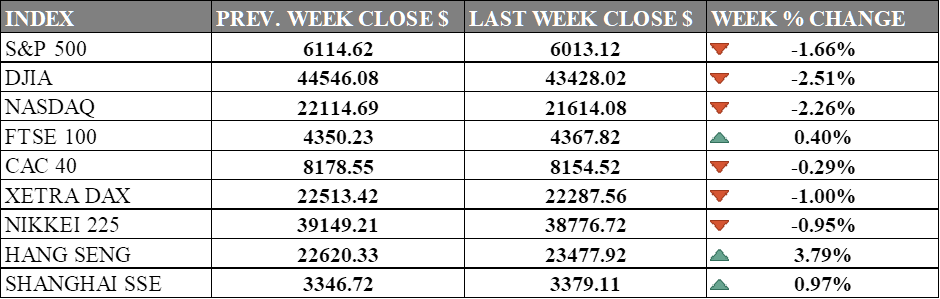

INDICES PERFORMANCE

Wall Street ended the week with declining performances across major indices. The S&P 500 fell by 1.66%, closing at 6,013.12, reflecting investor concerns and market pressure. The Dow Jones Industrial Average (DJIA) experienced a significant decline of 2.51%, finishing at 43,428.02, marking one of the larger drops among major indices. Meanwhile, the Nasdaq decreased by 2.26%, closing at 21,614.08, as the tech-heavy index faced notable selling pressure. U.S. services sector activity contracted unexpectedly, while consumer sentiment dropped to a 15-month low, partly due to concerns over President Trump's policies in tariffs and spending cuts.

European markets showed mixed results, with minimal movement overall. The UK's FTSE 100 managed a slight gain of 0.40%, closing at 4,367.82, showing resilience amid broader market weakness. France's CAC 40 experienced a minor decline of 0.29%, ending at 8,154.52, while Germany's XETRA DAX fell by 1.00%, closing at 22,287.56. The trend snapped a supposedly 7th week winning streak, only broken due to election concern and Britain retail sales data.

Asian markets displayed divergent trends. Japan's Nikkei 225 declined by 0.95%, closing at 38,776.72, aligning with the negative sentiment seen in other major markets. However, Hong Kong's Hang Seng Index showed remarkable strength, surging by 3.79%, finishing at 23,477.92, standing out as one of the week's best performers. In mainland China, the Shanghai Composite Index posted a modest gain of 0.97%, ending at 3,379.11. The rally is attributed to Chinese technology stocks following Alibaba's strong earnings report and optimism surrounding China's AI capabilities.

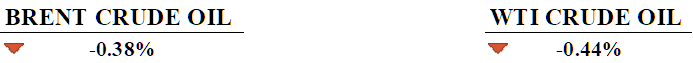

CRUDE OIL PERFORMANCE

Crude oil markets was swinging back and fort and ended up dropping for the fifth consecutive week, as geopolitical improvement and macroeconomic factors limited price gains. WTI crude settled at $70.18 per barrel, down 3.24% on Friday and 0.44% for the week, while Brent fell 0.38% weekly to $74.23 per barrel. Supply concerns were fueled by a Ukrainian drone attack that reduced Caspian Pipeline Consortium oil flows by 30-40%, though Kazakhstan maintained record-high output even with damage to its export route. Weaker-than-expected U.S. economic data and a stronger dollar pressured prices, accelerating technical selling after prices breached the 100-day moving average. OPEC+ maintained its gradual production increase plan starting in April, but discussions about delaying supply hikes provided some support, alongside expectations of tighter U.S. sanctions on Iranian oil exports. Meanwhile, rising U.S. crude inventories and weakening Chinese demand added bearish pressure, with analysts anticipating demand boosts from cold weather in the U.S. and increased industrial activity in China in the coming weeks.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. jobless claims rose to 219,000, pointing toward a resilient labour market. The Fed remains cautious on rate cuts amid inflation risks from tariffs and geopolitical factors.

Swiss gold exports spiked in January with record shipments to the U.S. due to fears of Trump's proposed tariffs that could impact gold deliveries. This boosted Comex gold stocks by 116% and widened the price gap between U.S. futures and London spot prices.

What Can We Expect from The Market This Week

US PCE Price Index: After concerning inflation figures earlier this month, the PCE Price Index will give clearer insight into possible Fed rate cut trajectory. Consensus fell with 0.3% growth after the December 2024 figure, showing a 0.3% monthly and 2.6% annual growth.

US GDP Q4: With a preliminary growth rate of 2.3% for the fourth quarter of 2024, it suggests a normalised economic development, driven by consumer and government spending. Other economies, such as Germany, Switzerland, and Canada, are also reporting on their economic growth, which is much lower even when combined compared to the U.S.

CB Consumer Confidence: The index is closely watched to match with the recent dip in the business survey, with a lower expectation of 103.3 after January 2025 showing a slight decline to 104.1, although still within the stable range.

Chicago PMI: Manufacturing in Chicago continues to contract with January 2025 figures at 39.5, even with positive developments in new orders, production, and inventories. Related news, including the Federal Reserve's activity index and policy discussions around tariffs, is suggesting that the coming months will be pivotal for recovery or further contraction.

BoJ Core CPI: Excluding food and energy, inflation figures for January see a 1.9% annual growth while national CPI is at 4%, exceeding analysts' expectations and increasing speculation that the BoJ will hike rates again. This shift from deflation to sustained inflation requires the BoJ to balance price stability and economic support.