PAST WEEK'S NEWS (March 17 – March 21)

A federal judge blocked Elon Musk and the Department of Government Efficiency from further actions to shut down the U.S. Agency for International Development (USAID), ruling that their efforts likely violated the Constitution by usurping Congress's authority and bypassing proper appointment procedures. The judge ordered the restoration of computer system access for USAID employees and contractors, who had been locked out after the administration froze foreign aid and placed many on leave. The ruling stemmed from a lawsuit by USAID employees alleging that Musk effectively took control of the agency without proper authority. Although the judge did not stop the mass terminations of contracts and personnel, he noted these actions were likely unconstitutional but executed by other officials. Trump criticised the ruling, calling the judge "rogue," and vowed to appeal. Meanwhile, Secretary of State Marco Rubio announced significant cuts to USAID’s programmes and staff, indicating the administration’s intent to continue downsizing the agency.

Nvidia successfully hosted a quantum computing event during its GTC Conference, boosting quantum stock prices prior to the event as investors anticipated positive developments even with scepticism from CEO Jensen Huang in January, when he doubted quantum computers would be useful within 15 years. However, during the event on Thursday, Huang’s attempt to clarify his earlier stance accidentally cast doubt on quantum viability by emphasising its complexities and long-term timeline, sending quantum stocks falling, which he did not realise were publicly traded. In response, Huang attempted to make amends by admitting his January remarks were misinterpreted, expressing surprise at their market impact, and reframing quantum computers as scientific instruments with the potential to accelerate instead of replacing traditional computing.

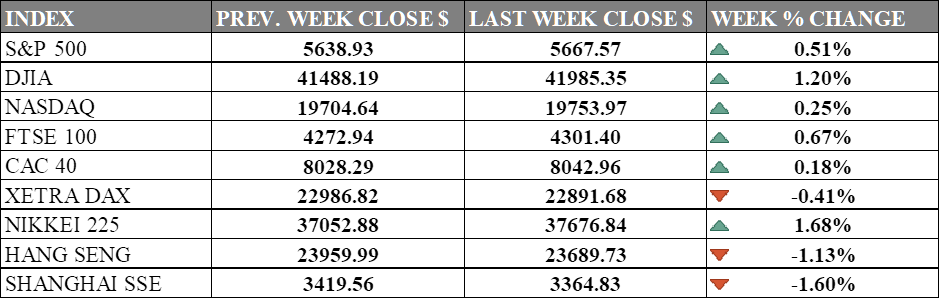

INDICES PERFORMANCE

Wall Street ended the week with modest gain. The S&P 500 rose by 0.51%, closing at 5667.57, reflecting modest broad market strength. The Dow Jones Industrial Average (DJIA) see a more significant gain of 1.20%, finishing at 41985.35, showing resilience amid market fluctuations. Meanwhile, the Nasdaq only gained slightly by 0.25%, closing at 19753.97, as tech continue to struggle. The tempered recovery may be due to bargain hunting as market usually rebound once it hit 10% below peak.

European markets also showed limited yet positive momentum. The UK's FTSE 100 gained 0.67%, closing at 4301.40. France's CAC 40 experienced a modest increase of 0.18%, ending at 8042.96, while Germany's XETRA DAX was the only major index to decline, falling by 0.41%, closing at 22891.68. European markets had run out of steam from the renewed defence spending bill and now facing trump trade policy as its main risk factor.

Asian markets displayed mixed trends. Japan's Nikkei 225 posted a strong gain of 1.68%, closing at 37676.84, following a pause in BoJ interest rate hike path. In contrast, Hong Kong's Hang Seng Index weakened, falling by 1.13%, finishing at 23689.73. In mainland China, the Shanghai Composite Index declined by 1.60%, ending at 3364.83, continued to weighed down by being the main target of U.S. trade tariff war.

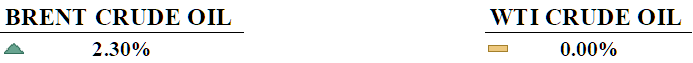

CRUDE OIL PERFORMANCE

Brent crude futures secured a second consecutive weekly gain of 2.3%, closing at $71.13 per barrel on Friday, while WTI crude stagnated at $67.10, boosted by new U.S. sanctions on Iran and an OPEC+ plan for additional output cuts. The U.S. Treasury imposed sanctions targeting Chinese refineries and vessels importing Iranian crude, which analysts predict could reduce Iranian exports by 1 million barrels per day. OPEC+ plans to implement additional output cuts between 189,000 and 435,000 barrels per day until June 2026 to counterbalance planned production increases and stabilize the market. However, oil prices face additional challenge as President Trump's trade policies, including 25% tariffs on imports from Canada and Mexico effective April 2, and 20% on Chinese imports, threaten to slow global economic growth and oil demand. The OECD has cut its 2025 global economic growth forecast to 3.1% from 3.3%, citing U.S. policies that restrict trade flows and further slow China's economy, which is already struggling with property sector issues and high youth unemployment. The market outlook is further complicated by rising supply outside of OPEC+ and the cartel's plans to begin returning 2.2 million barrels per day of production cuts to market in monthly tranches..

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. jobless claims inched up to 223,000 last week, indicating a resilient labour market despite trade tensions and federal workforce cuts led by Elon Musk’s Department of Government Efficiency.

The Federal Reserve kept interest rates steady at 4.25%-4.5%, citing uncertainty over Trump’s tariffs, while stock futures dipped after the jobless data release.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The FOMC continues to balance the need to stimulate growth and limit inflation, now with the effects of trade disputes and tariff policies. The March meeting is expected to see the Fed maintaining rates, remaining in a cautious wait-and-see approach in response to mixed signals from inflation data, employment trends, and market expectations.

BoJ Interest Rate Decision: Analysts predict rates will remain unchanged for now but could rise to 0.75% later in the year due to signs of demand-driven inflation as factors including a 0.3% rise in producer prices in January and 3.1% annual growth in bank lending suggest growing economic momentum. Market expectations are influenced by Keidanren’s Masakazu Tokura on demand-led price growth, bond purchase speculation, and global factors like trade tensions and China’s economy.

SNB Interest Rate Decision: The market is divided between a 25-basis point cut to stimulate its slowing economy or a hold to preserve monetary policy flexibility given the volatile market. This move will not only impact the the Swiss franc but also shifts in monetary policy as central banks worldwide buying into safety.

BoE Interest Rate Decision: The Bank of England faces mounting pressure as tariffs and inflation disrupt the UK economy, forcing policymakers to balance growth and rising prices. After a 25-basis-point rate cut in May, markets now expect a total of 56 bps in reductions by December, but uncertainty lingers as inflation remains high and economic growth slows.

Eurozone CPI: Preliminary data shows inflation eased to 2.4% in February 2025, but persistent core inflation and global trade risks complicate the ECB’s monetary policy decisions. Markets remain volatile as investors assess the ECB’s stance in retaliation to economic stagnation and inflationary pressures.