PAST WEEK'S NEWS (July 18 – August 22)

Finance industry groups are urging the Basel Committee on Banking Supervision to pause restrictive crypto asset standards set to be implemented in January 2026, arguing that the regulations make it uneconomical for banks to participate meaningfully in cryptocurrency markets. The industry coalition, including major financial associations and crypto groups, contends that the crypto market has evolved significantly since the 2022 standards were established, making the current approach too conservative given the sector's growth and increasing integration with mainstream finance. Meanwhile, Federal Reserve Vice Chair Michelle Bowman has signalled a notable shift in regulatory thinking by proposing that Fed staff should be allowed to hold limited amounts of digital assets to gain practical experience for better supervision of crypto markets. This regulatory recalibration occurring under the Trump administration's pro-crypto stance will lead to better oversight frameworks, giving room for innovation and financial stability.

All eyes are on the Fed Chairman Jerome Powell at Friday's Jackson Hole speech, with markets pricing in a lower odds of a September rate cut than last week, currently at 83%, even with headline inflation running a full percentage point above the Fed's 2% target. Recent economic data presents conflicting signals: July's weak jobs report of only 73,000 new positions suggests labour market softening, while increases in services inflation have raised concerns among Fed officials about declaring victory over rising costs. Powell will likely unveil the Fed's updated policy framework, moving away from the 2020 flexible average inflation targeting approach that may have contributed to recent inflation overshoots. The Fed chair had also been facing relentless pressure from President Trump to cut rates before tariffs set in, raising doubts of the central bank's independence. Markets will closely scrutinise Powell's remarks for policy hints, though analysts expect only vague language that may disappoint traders seeking clearer direction.

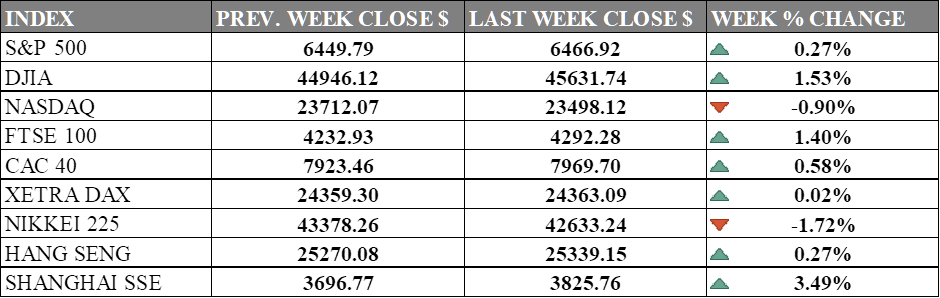

INDICES PERFORMANCE

Wall Street major indices posted mixed results as market sentiment remained sticky on inflation and rate cut. The S&P 500 rose modestly by 0.27%, closing at 6466.92, with most gain on Friday as market react to Fed Chair Powell Jackson Hole Speech. The Dow Jones Industrial Average (DJIA) delivered the strongest performance among major US indices with a gain of 1.53%, finishing at 45631.74. The Nasdaq declined by 0.90%, closing at 23498.12, as tech stocks faced selling pressure from investor rotating into value stocks instead.

European markets posted positive results during the period, with gains across major indices. The UK's FTSE 100 advanced by 1.40%, closing at 4292.28. France's CAC 40 gained 0.58%, ending at 7969.70, while Germany's XETRA DAX showed minimal movement with a slight increase of 0.02%, closing at 24363.09. European markets maintained steady momentum despite global uncertainties.

Asian markets showed mixed performance across the region. Japan's Nikkei 225 declined by 1.72%, closing at 42633.24, reflecting some investor caution amid global market volatility. Hong Kong's Hang Seng Index rose modestly by 0.27%, finishing at 25339.15, while mainland China's Shanghai Composite Index delivered the strongest regional performance with a gain of 3.49%, ending at 3825.76, as Chinese markets showed renewed strength.

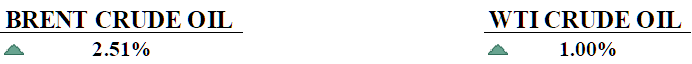

CRUDE OIL PERFORMANCE

Crude oil prices rose last week, posting their first weekly gain in three weeks, as fading hopes for an imminent Russia-Ukraine ceasefire heightened supply disruption risks. Geopolitical tensions remain even with the U.S. President’s proposed peace summit, with both sides blaming each other for stalled talks and continuing military strikes on energy infrastructure, including key Russian oil facilities and pipelines. Market sentiment was further supported by a larger-than-expected 6 million barrel draw in U.S. crude inventories, while the active oil and gas rig count fell to a five-week low, pointing to potential production declines with strong demand. Federal Reserve Chair Jerome Powell’s dovish remarks at Jackson Hole boosted expectations for a September rate cut, with markets pricing in an 87.3% probability, lifting risk assets and oil demand outlook. Meanwhile, upcoming U.S. tariffs on Indian imports with target being India’s continued purchases of discounted Russian oil have introduced additional market variables, with potential upside risks if supply redirection challenges emerge.

OTHER IMPORTANT MACRO DATA AND EVENTS

Germany’s economy contracted more than expected in Q2, weighed down by weak investment, construction, and exports, with analysts warning that recessionary pressures, trade headwinds, and fiscal uncertainty make a meaningful recovery before 2026 unlikely.

Japan’s July CPI reflect easing price pressure but core prices stay stubbornly high above the BOJ’s 2% target, reinforcing expectations of further rate hikes.

What Can We Expect from The Market This Week

US New Home Sales: Sales of new homes reached a seasonally adjusted annual rate of 627,000 units in June, up from 623,000 units in May, revealing continued resilience in the housing market despite high mortgage rates. The average sales price declined to $501,000 in June from $511,500 in May, a 2.0% drop, with affordability concerns still lingering.

US Durable Goods Order: Orders for long-term goods declined 9.3% to $311.8 billion in June, reversing the tariff-induced 16.5% buying spree recorded in May and indicating increased volatility in manufacturing demand. The decline was better than the forecasted -10.4%, but it highlights uncertainty in business investment due to tariff and trade risk.

German CPI: German inflation remained stable at 2.0% for the second month, meeting the European Central Bank's target. Core inflation (excluding energy and food) held high at 2.7%, suggesting underlying price pressures even with a pretty headline rate.

US PCE Price Index: The personal consumption index charged to 2.6% in annual rate, up from an upwardly revised 2.4% in May, marking the highest inflation rate in four months. Core PCE, the Federal Reserve's preferred inflation gauge, remained elevated at 2.8% annually, above the Fed's 2% target.

Chicago PMI: Chicago's manufacturing sector has been in contraction for the twentieth month, though it gained 6.7 points to 47.1 in July compared to 40.4 in June, marking the largest monthly improvement in thirteen months and bringing the index to its highest level since recent lows. Business activity in the region is still declining but at a slower pace.