Stocks Performance (U.S. Stocks)

Most key global stock markets closed at a six-week low after wobbling in reaction to central bank statements, and stalled negotiations in the U.S. and Europe over fiscal stimulus measures and Brexit terms, as well as the weakness in technology stocks.

The week started on a bullish note, with the market rebounding from back-to-back weekly declines, but discouraged after the FOMC policy decision.

In other news, Snowflake doubled the shares in the biggest tech IPO ever, Apple fell 4.6% for the week, dragging the S&P 500 technology sector down with it. AstraZeneca resumed its COVID-19 vaccine trials in the UK, and NVIDIA agreed to acquire Arm Holdings from Softbank for $40 billion in cash and stock.

Last week top loser, U.S. auto-parts maker Garrett Motion officially files for bankruptcy protection while also proposing a $2.1B sale of the business to private-equity firm KPS Capital Partners.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at 6.90%, followed by Health Technology sector at 3.04%, Health Services at 2.18%, and Distribution Services at 2.04%. Meanwhile, the weakest sectors were from the Retail Trade (-1.78%), Consumer Non-Durables (-1.60%), Technology Services (-0.63%), and Electronic Technology sector (-0.63%).

Indices Performance

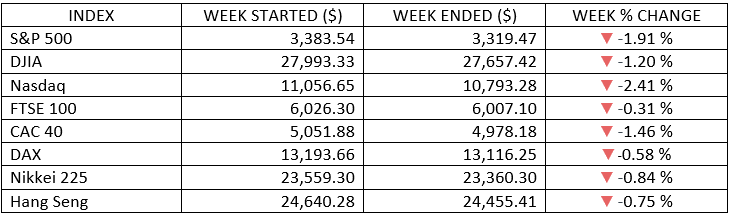

The major U.S. stock indexes fell for the third week in a row, retreating again from the record highs that the S&P 500 and the NASDAQ achieved early this month.

Japanese stocks edged lower as the Bank of Japan said that it would hold rates steady. In Europe, concern about Brexit negotiations and a dramatic rise in new COVID-19 cases pushed stocks lower.

Oil Sector Performance

After two weeks of declines, U.S. crude oil prices recovered ground, climbing back to around $41 per barrel. Much of the week’s gain came on Wednesday, after the government reported that U.S. crude oil supplies fell to the lowest level in five months, as well as Saudi Arabia’s efforts to force production cuts by other major oil exporters.

Market-Moving News

Slight Decline

The major U.S. stock indexes fell for the third week in a row, retreating again from the record highs that the S&P 500 and the NASDAQ achieved early this month. The latest week’s decline was much smaller than the previous week’s pullback.

Small-Cap Surge

U.S. small-cap stocks had a breakout week, outperforming large caps by a wide margin. The Russell 2000 Index, a small-cap benchmark, gained nearly 3%. Though, YTD, small caps lag far behind large caps.

Near-Zero Rate Outlook

The U.S. Federal Reserve kept interest rates unchanged and signaled that it expects to keep its benchmark rate near zero for at least three more years.

Buyback Pullback

The economic impact of COVID-19 led many companies to take a cautious approach with corporate cash, as spending to buy back company shares plunged during this year’s second quarter. Share repurchases by companies in the S&P 500 dropped 55% from this year’s first quarter, according to S&P Dow Jones Indices.

Oil Recovery

After two weeks of declines, U.S. crude oil prices recovered ground, climbing back to around $41 per barrel. Much of the week’s gain came on Wednesday, after the government reported that U.S. crude oil supplies fell to the lowest level in five months.

Consumer Confidence

A monthly gauge of U.S. consumer sentiment climbed to the highest level since March of this year, according to a preliminary reading on Friday from a University of Michigan survey. However, the index remains below its level in February, before the coronavirus pandemic began to weigh heavily on the economy.

Other Important Macro Data and Events

U.S. stocks closed at a six-week low, driven by weakness in technology stocks, lower for the third week in a row. On the flip side, cyclical, small-cap and international stocks, and oil, all rebounded, finishing positive for the week.

The U.S. Federal Reserve was unexpectedly dovish in its policy statement The Fed kept interest rates unchanged and signaled that it expects to keep its benchmark rate near zero for at least three more years. All 17 Fed officials who made projections said they expect to keep rates near zero at least through next year, and 13 projected rates would stay there through 2023.

U.S. Treasuries traded near their flat lines all week. The 2-yr yield remained unchanged at 0.13%, and the 10-yr yield increased two basis points to 0.69%. The U.S. Dollar Index declined 0.4% to 92.95.

The Bank of England surprised markets with the news that it is actively discussing the possibility of negative rates in the UK.

In Europe, the risk of the UK leaving the EU without a free-trade agreement is rising, as Britain moves to violate terms of the post-Brexit deal that it signed earlier this year. Also, a dramatic rise in new COVID-19 cases dominated a better-than-expected German ZEW investor sentiment index and pushed stocks lower. The number of new coronavirus cases reported weekly in Europe hit 300,000 for the first time.

Japanese stocks edged lower as the Bank of Japan said that it would hold rates steady. A steady course in fiscal policy was also expected after Yoshihide Suga won the LDP leadership vote to take over the role of Prime Minister from Shinzo Abe.

What We Can Expect from the Market this Week

The election is a month and a half away, and as the campaigns ramp up, so too will political uncertainties, accompanied by polarizing rhetoric and headlines. This election highlights the difference between Trump and Biden on key policy elements such as taxes, regulation, and the government’s role in economic growth. Though market performance is driven principally by fundamentals, to some extent, the market will react.

We think the combination of a sustained but gradual economic expansion, an extension of monetary-policy stimulus and a rebound in corporate profits will set the broader course for the markets.

Important economic news released this week including existing home sales on Tuesday, weekly unemployment claims along with the new home sales on Thursday, and durable goods on Friday.