All eyes are on Venezuelan President Nicolás Maduro, who was captured by US special forces in Caracas and flown aboard the USS Iwo Jima to New York, where he now faces federal drug trafficking and narcoterrorism charges. The 63-year-old leader pleaded not guilty in Brooklyn federal court alongside his wife, with prosecutors pursuing charges that could carry a life sentence. The operation has already drawn condemnation from the United Nations, which warned it violated the UN Charter and set a dangerous precedent, though US courts have historically dismissed immunity claims by foreign leaders. The seizure of Maduro has rattled governments worldwide by exposing how little protection international law offers against unilateral action by a hyperpower. Analysts warn the episode could push smaller states to rethink their security strategies, with some viewing nuclear deterrence as the only credible safeguard of sovereignty in an increasingly unstable global order.

Federal Reserve Governor Stephen Miran made a volatile call by expecting 150 basis points of rate cuts for 2026, triple the market consensus of just 50 basis points, arguing that monetary policy remains excessively restrictive and is stalling job creation as the unemployment rate gradually creeps upward from 4.4% to 4.6%. Miran's stance would bring the federal funds rate down to 2.00%-2.25% by year-end, while most bond market participants expect only 50 basis points of cuts with a 45% probability of the first one by April. This creates uncertainty that coincides with a current market rotation where investors are abandoning last year's tech darlings in favour of previously beaten-down sectors, with energy and defence stocks rising while megacap technology names struggle to maintain momentum. The extreme valuations are finally snapping back toward equilibrium, as money pours out of overextended positions in stocks like Nvidia and into sectors positioned to benefit from geopolitical tensions and energy transition dynamics. Defence contractors like Northrop Grumman have rallied over 10% on U.S. budget plan, while the broader market suffers from chipmaker weakness and software sector downturn.

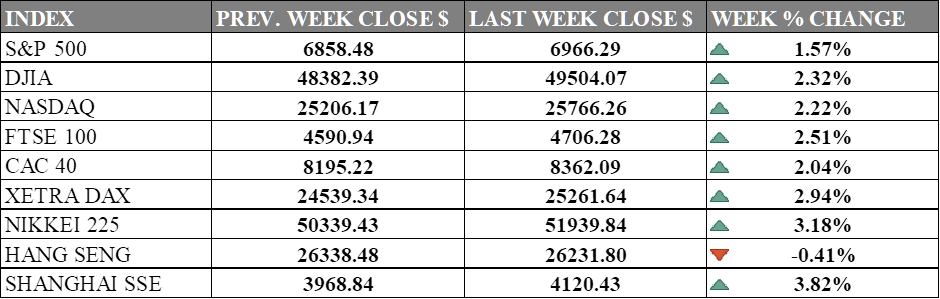

INDICES PERFORMANCE

Wall Street's major indices advanced this first full week of 2026. The S&P 500 rose 1.57% to 6,966.29, while the Dow Jones Industrial Average climbed 2.32% to 49,504.07. The Nasdaq gained 2.22% to 25,766.26, as technology stocks recovered some ground amid improved market sentiment and solid corporate earnings. Market momentum strengthened as investors digested positive economic data and reassessed expectations for corporate performance in the coming quarters while banking earning season is in.

European markets posted strong gains this week. The UK's FTSE 100 surged 2.51% to 4,706.28, marking a robust advance. France's CAC 40 rose 2.04% to 8,362.09, while Germany's XETRA DAX led regional markets with a 2.94% gain to 25,261.64. Investor sentiment in the region remained positive, reflecting strong corporate earnings and renewed confidence in economic growth prospects despite lingering monetary policy considerations.

Asian markets showed divergent performance this week. Japan's Nikkei 225 surged 3.18% to 51,939.84, leading regional gains with strong momentum although its currency keep weakening. China's Shanghai Composite jumped 3.82% to 4,120.43, reflecting growing investor optimism about domestic policy support. In contrast, Hong Kong's Hang Seng Index declined 0.41% to 26,231.80, bucking the broader regional trend. The mixed regional performance reflected varying investor responses to policy developments and global macroeconomic conditions.

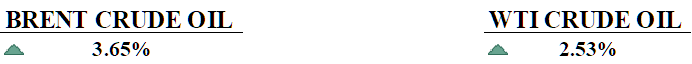

CRUDE OIL PERFORMANCE

Oil markets enter 2026 with a heavy surplus that is expected to peak in the first quarter, keeping Brent near $60 before improving as the surplus gradually narrows through the year. UBS views 2026 as a transition year, with prices stabilising after Q1 and recovering as investor focus shifts to shrinking spare capacity and relatively resilient demand. Supply risks dominate, with disruptions in Russia, Venezuela or Iran capable of quickly tightening markets, while upside remains capped by OPEC+ spare capacity and the risk of unwinding production cuts. Venezuelan crude exports to the U.S. are resuming but face major logistical, storage and shipping constraints that limit near-term supply additions. Geopolitical tensions, particularly unrest and threats to Iranian oil infrastructure, have recently supported prices despite oversupply concerns. Longer term, both UBS and Bernstein see 2026 as the cycle low, with Brent recovering toward $70 in 2027 as non-OPEC supply growth slows and investment constraints persist.

OTHER IMPORTANT MACRO DATA AND EVENTS

President Trump prematurely shared unreleased December jobs data on social media to brag about job addition in private sector and fewer government job, though the White House acknowledged it as breach of protocol.

December's weaker job growth (50,000 vs. 66,000 forecast) combined with a slight dip in the unemployment rate to 4.4% bolstered market expectations that the Federal Reserve will hold interest rates steady at its January meeting.

What Can We Expect from The Market This Week

US CPI December: The headline index is currently at 2.7% year-over-year in November, below forecasts of 3.1% and a whole 0.3% lower than the previous month, marking a significant deceleration from previous months, according to the Bureau of Labour Statistics. The December CPI report is forecasted to be around 2.8% annually.

UK GDP: The UK economy expanded by just 0.1% in Q3 2025, confirming preliminary estimates and slowing from 0.3% growth in the previous quarter. October data shows a continuing decline for two consecutive months, though November data is forecasted to stay flat.

German CPI: Germany's preliminary annual inflation rate fell to 1.8% in December 2025, down from 2.3% in November and below market expectations of 2.0%, marking the slowest pace in 15 months. The decline was driven by slower food price inflation at 0.8% and brings German inflation below the European Central Bank's 2% target.

US Retail Sales: Retail and food services sales remained flat in October 2025 but were up 3.5% from October 2024 on a year-over-year basis. Holiday retail sales for November-December showed strong momentum with 4% growth, according to Visa and Mastercard data, in line with National Retail Federation forecasts.

US New Home Sales: Sales of new single-family homes jumped to a seasonally adjusted annual rate of 800,000 units in August while latest data lags due to shutdown. The median sales price of new houses reached $413,500, up 1.9% from the previous year.