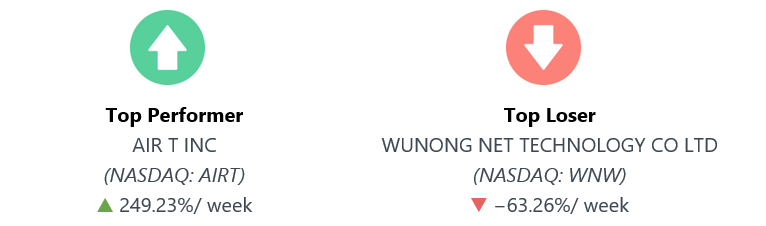

Stocks Performance (U.S. Stocks)

Stocks were mixed last week as investors weighed lawmakers' approval of a long-awaited relief bill against ongoing virus concerns and new U.K. travel bans, plus Brexit deal. Markets closed early Thursday and were shuttered on Friday in observance of the Christmas holiday.

The UK and the EU finally agreed on a post-Brexit trade deal, with the announcement coming after UK markets closed.

On the potential stimulus checks, President Trump being back and forth, casted doubt and could delay the approved $900 billion stimulus deal with a pocket veto. House Speaker Pelosi scheduled a full House vote on Monday to increase stimulus checks to $2000 from $600, though Republicans appeared less willing to compromise.

On the coronavirus front, the market was worried about a new strain of coronavirus primarily in the UK that spreads 70% faster than other variants. Follow-up reports suggested that the new variant isn't more deadly or resistant to vaccines. Separately, Pfizer (NYSE: PFE) and BioNTech (NASDAQ: BNTX) reached a second agreement with the U.S. government to supply an additional 100 million doses of their COVID-19 vaccine. The U.S. has continued its vaccination effort, with over 1 million people receiving the first dose of the new vaccine.

By sectors, the most outperformed weekly stocks were led by Electronic Technology sector at 0.86%, followed by Commercial Services at 0.85%, Producer Manufacturing (0.75%), and Technology Services at 0.56%. Meanwhile, the weakest sectors were from the Energy Minerals at -3.20%, Retail Trade at -2.91%, Industrial Services (-2.17%), and Non-Energy Minerals sector (-1.19%).

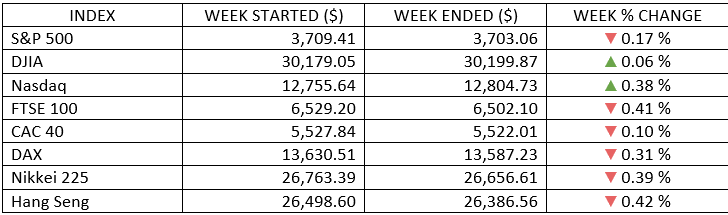

Indices Performance

There was no so-called Santa Claus rally over the holiday-shortened trading week. Major U.S. indexes largely been stationary in the week, with the S&P 500 edged lower, while the Nasdaq Composite and Dow Jones Industrial Average eked out gains.

Shares in Europe were roughly flat for the week ended Thursday, as hopes for a UK-EU trade deal helped reverse sharp losses caused by the emergence of a new variant of the coronavirus.

Japanese stocks also declined. The Nikkei 225 Stock Average fell 95 points for the week. For the YTD period, the benchmark is ahead 12.7%.

China’s benchmark stock index also fell as a flareup in Sino-U.S. tensions weighed on sentiment. On Monday, the Trump administration published a list of Chinese and Russian companies that it alleged had ties to their countries’ militaries. The list of 58 Chinese and 45 Russian companies requires a license for anyone seeking to sell them items that could be used for military purposes, according to a Commerce Department statement.

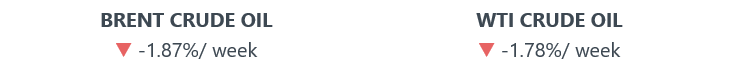

Oil Sector Performance

Oil prices logged its first weekly decline after seven straight weekly gain. The oil decline over the week was as a new coronavirus strain in Britain revived concerns over demand recovery.

Market-Moving News

Holiday Holding Pattern

The major stock indexes posted mixed results heading into the closing days of 2020. Stocks have largely been stationary over the first four weeks of December, in contrast with November, when the S&P 500 gained nearly 11% and surged to a record high.

Supercharged Small Caps

Small-cap stocks again outperformed their large-cap peers for the week as the Russell 2000 Index, a small-cap benchmark, closed above the 2,000-point level for the first time and extended the equity category’s fourth-quarter rally. Since the end of September, the index has gained 33%; it surpassed its prior record in November.

Stimulus Doubt

A $900 billion coronavirus relief package that emerged from months of congressional negotiations was thrown into doubt after President Trump objected, saying that the measure’s direct payments to citizens were too small. Investors kept a close eye on the wrangling over the package, which was tied to a spending measure needed to avoid a partial government shutdown.

Brexit Resolution

The UK and the EU on Thursday finally reached a Brexit trade deal with just days left until the end of the transition period in the UK’s exit from the EU. The agreement will allow hundreds of billions of dollars in goods to continue to flow between the UK and the 27 remaining nations in the EU.

Labor Troubles

New claims for unemployment benefits remained above 800,000 for the third week in a row, following a stretch of nearly two months in which they were below that level. However, the latest weekly tally of 803,000 claims was down from a revised figure of 892,000 in the previous week.

Other Important Macro Data and Events

Economic data showed that the economic recovery is losing some momentum amidst rising virus cases and renewed restrictions in activity. Consumer confidence has seen a short-term dip, and weekly jobless claims rose unexpectedly.

The yield on the benchmark 10-year Treasury note fell slightly for the week as investors weighed the mixed economic data, news on the coronavirus, and reports that a Brexit trade agreement was in sight.

The UK and the EU on Thursday finally reached a Brexit trade deal with just days left until the end of the transition period in the UK’s exit from the EU. The agreement will allow hundreds of billions of dollars in goods to continue to flow between the UK and the 27 remaining nations in the EU.

What We Can Expect from the Market this Week

The U.S. fiscal stimulus yet to face another hurdle. The relief package that emerged from months of congressional negotiations was thrown into doubt after President Trump objected, saying that the measure’s direct payments to citizens were too small. Investors kept a close eye on the wrangling over the package, which was tied to a spending measure needed to avoid a partial government shutdown and contains key funding for vaccine distribution.

Anxiety over the pandemic and its impact on the global economy also remained high as coronavirus cases and deaths continued to rise in the United States and other countries, while the new variants of COVID-19 emerged in the UK and parts of Africa.

The transition week from 2020 to 2021 will be a light one in terms of economic reports. The U.S. labour market report that’s typically released on the first Friday of each month, for this week, will be delayed until January 8. Other reports still will be released, including home prices index on Tuesday, followed by pending home sales on Wednesday and weekly unemployment claims data on Thursday, before the financial markets closed on Friday, for New Year's holiday.