Stocks Performance (U.S. Stocks)

The holiday shortened trading week saw the major indexes hit all-time highs but ended the week mixed, as another round of unemployment benefits and stimulus checks were announced. President Trump signed the $900 billion aid on Sunday night, while the week also saw the signing of a long-awaited Brexit deal between the U.K. and the E.U, thus formalizing the departure of the UK from the European Union.

The market being increasingly focused on the rising coronavirus case count and increase in hospitalizations and initial stages of the vaccine rollout. The U.S. has continued its vaccination effort, with most other countries also had started their vaccination inoculation last week gradually, with the UK become the first to approve the COVID-19 vaccine from AstraZeneca/Oxford for emergency use.

Trading was relatively light ahead of the market’s closure on Friday in observance of the New Year’s Day holiday.

By sectors, the most outperformed weekly stocks were led by Consumer Durables sector at 3.64%, followed by Consumer Services at 2.73%, Utilities (2.12%), and Finance at 2.09%. Meanwhile, the weakest sectors were from the Energy Minerals at -1.25%, Industrial Services at -0.64%, Technology Services (-0.38%), and Retail Trade sector (0.27%).

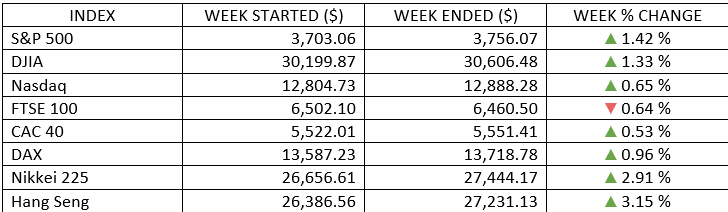

Indices Performance

Markets were generally calm in a holiday-shortened week amid continuing gridlock in Washington over further coronavirus relief. The U.S. major indexes ended the week mixed, though closed out a year of solid gains led by the technology-heavy Nasdaq Composite, which notched its best annual performance since 2009.

Shares in Europe rose, lifted by the UK-EU trade accord and the approval of a U.S. fiscal stimulus package.

The UK’s FTSE 100 Index recorded losses, partly due to the stronger British pound, which reached $1.3675, its highest level in a year. The UK market also edged lower, as England extended its toughest coronavirus restrictions to three quarters of the population.

Japanese stocks rallied in the holiday-shortened trading week through Wednesday. The Nikkei 225 Stock Average advanced almost 3% (788 points) and closed at 27,444.17, just off the 30-year closing high set on Tuesday.

Chinese stocks also finished the week at multiyear highs as investors anticipated stronger growth in 2021.

Oil Sector Performance

Oil prices logged its weekly gain, supported by a draw in U.S. crude inventories and Britain's approval of a second coronavirus vaccine.

OPEC+ will meet on Monday to decide on production levels for February.

Market-Moving News

Closing 2020 on a High Note

The major U.S. stock indexes all set record highs over the course of 2020’s final week, posting gains of around 1%.

A Turbulent 2020

A year that was weighed down by a pandemic and a sudden end to the longest bull market in history nevertheless ended positive overall for the stock market. The major indexes produced widely varying gains, with the NASDAQ adding nearly 44% on a price basis, the S&P 500 around 16%, and the Dow about 7%.

Small-Cap Record

While small-cap stocks trailed their large-cap peers for the week, they nevertheless wrapped up a record-breaking quarter. The Russell 2000 Index, a small-cap benchmark, climbed about 31% over the final three months of 2020, the biggest quarterly gain recorded in data going back to 1979.

Bitcoin Jackpot

Bitcoin accelerated its Q4 surge as the price jumped around 16% for the week and eclipsed $29,000 on Thursday for the first time. Bitcoin roughly quadrupled in price in 2020, as it started the year at around $7,200.

Dividend Rose Marginally

Despite COVID-19 and the surge in market volatility entering spring, 2020 was a record year but only barely for dividend payments by companies in the S&P 500. Total payments were up 0.07% from the previous year, according to S&P Dow Jones Indices. The year marked the ninth consecutive annual dividend payment record.

Other Important Macro Data and Events

The UK exit the EU at 23:00 GMT on December 31 after UK Prime Minister Johnson and EU leaders agreed to a post-Brexit trade agreement. The treaty came into UK law after Parliament voted overwhelmingly in favour of the deal.

The EU and China agreed on an investment treaty after seven years of talks. EU Trade Commissioner Valdis Dombrovskis said the EU would gain improved access to the Chinese market for automotive, private health care, cloud computing, and air transport services industries, among others. The EU would also receive similar benefits in the insurance and asset management industries to the ones secured by the U.S. in its “Phase 1” trade deal with China. The two sides have yet to ratify the treaty. The EU hopes it will come into effect in 2022.

The week’s light economic calendar was highlighted by housing data. Home prices rose at a faster pace than predicted in October, but November pending home sales unexpectedly fell 2.6%, reflecting constrained inventories. Weekly jobless claims defied expectations for an increase and fell to 787,000, the lowest level in almost a month.

The 10-yr yield declined one basis point to 0.92%, leaving it down 100 basis points for the year, as investors weighed the mixed economic data, news on the coronavirus, and the Brexit trade agreement.

Bitcoin accelerated above $29,000 on Thursday for the first time.

What We Can Expect from the Market this Week

Historically, January’s stock market performance has been a strong indicator of what may be in store for the rest of the year. In fact, more than 70% of the time the S&P 500 has posted a positive return for the year after gaining ground in January or has gone on to post an annual loss when the market has declined in the first month, according to S&P Dow Jones Indices.

Anxiety over the pandemic and its impact on the global economy also remained high as coronavirus cases, hospitalizations and deaths continued to rise globally.

The monthly labour market update due out on Friday is likely to be the week’s most closely watched economic report. The new release will show whether December marked the sixth consecutive month of a slowdown in jobs growth, or not.

Important economic news released this week including OPEC and non-OPEC Ministerial Meeting and construction spending on Monday, ADP employment change and factory order on Wednesday, unemployment claims and trade balance on Thursday, and consumer credit, wholesale inventories and labour market data on Friday.