Stocks Performance (U.S. Stocks)

U.S. political drama dominated the first week of 2021. Investors focused on the prospect of more economic stimulus in the wake of Democrats winning both Senate runoff elections in Georgia. Capital markets quickly shook off the astonishing overrunning of the U.S. Capitol Building by protestors this week. Investors also anticipating a calmer politicism, as Joe Biden’s election has been certified to be the next U.S. President.

The Jaguar Health (NASDAQ:JAGX) stock rallied last week as investors piled on to it, extending the pharmaceutical company's staggering gains since mid-November. Investors bid up the healthcare stock after management announced its plan to develop and commercialize crofelemer, a new drug aimed at helping people with inflammatory diarrhea, including those who have recovered from COVID-19 but are still experiencing symptoms. Meanwhile, the shares of Sarepta Therapeutics (NASDAQ: SRPT) lost around half their value in response to some disappointing clinical trial results.

Energy stocks outperforms, after Saudi Arabia made a surprise announcement that it was unilaterally cutting oil production by 1 million barrels per day.

By sectors, the most outperformed weekly stocks were led by Consumer Durables sector at 11.88%, followed by Energy Minerals at 10.39%, Non-Energy Minerals (9.21%), and Industrial Services at 5.95%. Meanwhile, the weakest sectors were from the Consumer Non-Durables at 0.02%, Utilities at 0.04%, Consumer Services (0.08%), and Communications sector (1.16%).

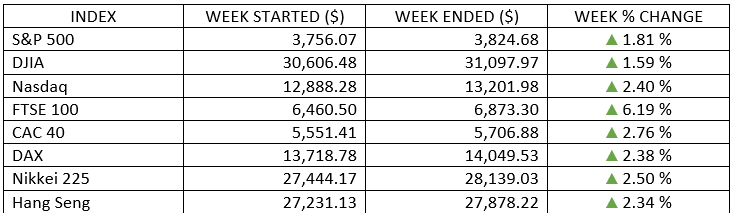

Indices Performance

Equity markets saw a strong start to the year globally, with major indexes hitting fresh record highs last week. The major U.S. indexes gains of around 2% and pushing to record levels some time of the week. Expectations of more U.S. stimulus helped to lift markets following Senate runoff elections in Georgia.

All major European and Asian stock markets also rode the wave of U.S stimulus optimism to higher levels, shrugged off the imposition of stricter regions lockdowns. Most European markets outperformed U.S. equity indices after economic data showed a better-than-expected euro-area performance.

Stocks in London were especially strong, rallied more than 6%, led by banking and energy stocks, despite a third lockdown across England, as the UK manufacturing PMI rose to a 3-1/2-year high, and the recent UK-EU Brexit agreement continued to boost investor confidence.

Oil Sector Performance

WTI crude jumped above US$50 per barrel for the first time since February, and the commodity continued to rise the rest of the week, topping $52 on Friday.

The week’s key catalyst was after prolonged discussions by the OPEC+ to keep total oil production flat, with Saudi Arabia compensating for a marginal increase in output by Russia and Kazakhstan of 75,000 bpd with a deepening of its own cuts. The Saudi Arabia then surprised the market by announcing that it will unilaterally cut an additional 1 million bpd of crude production, which led to a sharp increase in oil prices. Meanwhile, U.S. crude oil inventories dropped by 1.7 million barrels in the week to Jan 1 to 491.3 million barrels.

Market-Moving News

New Year Started on A High Note

Key market catalysts that played out in late 2020 extended into the first week of 2021, lifting the major U.S. indexes to gains of around 2% and pushing record levels higher. Expectations of further U.S. government stimulus also helped to lift markets following Senate runoff elections in Georgia.

Surging Small Caps

After posting a record-breaking quarterly gain of 31% in the just-completed Q4, a small-cap benchmark, the Russell 2000 Index, extended its rally into the new year. The index jumped around 6%, with most of the weekly rise coming from Wednesday’s single-day jump of 4%.

Oil Strengthened Above $50

The price of WTI crude oil climbed above $50 per barrel on Tuesday for the first time since last February, and the commodity continued to rise the rest of the week, topping $52 on Friday. The week’s key catalyst was an unexpected oil production cut announcement by Saudi Arabia.

Bitcoin Reaches $40K

Bitcoin extended its surge as the price blew past the $30,000 mark early in the week and eclipsed $40,000 for a while on Friday. The rally in the first week of the new year came after bitcoin roughly quadrupled in price in 2020, as it started that year at around $7,200.

Jobs Setback

Friday’s monthly U.S. labor market report marked the first time since April 2020 that jobs have declined rather than increased. The reported drop was 140,000 jobs. The labor market has nearly 10 million fewer jobs than it did in February 2020.

Yields Climb

The yield of the 10-year U.S. Treasury bond eclipsed 1.00% on Wednesday for the first time since early March 2020, when the impact of the pandemic sent yields sharply lower. The yield continued to surge as the week progressed, reaching 1.11% on Friday.

Earnings Upgrade

Wall Street analysts’ profit forecasts for the quarterly earnings season that opens this week have recently been rising. According to FactSet, projections of earnings by companies in the S&P 500 increased by 2.3% over the course of last year’s fourth quarter.

Dividend Restoration

A growing number of U.S. companies that cut dividends in response to the pandemic’s impact began to restore those payment levels in the just-completed Q4. Net dividend changes totalled $9.5 billion, compared with a decline of $2.3 billion in the Q3 of 2020, according to S&P Dow Jones Indices.

Other Important Macro Data and Events

The NYSE moved ahead with delisting three Chinese telecommunications companies. Trading of the three securities will be suspended at 4 p.m. ET Monday, the exchange said.

US economic data was mixed, with both manufacturing and services PMIs unexpectedly rising, while jobs reports showed a sharp slowdown in hiring. However, the weak payroll data served to bolster the anticipation of further stimulus.

Congress resumes certification of Biden's win after Trump supporters storm U.S. Capitol.

Positive sentiment boosted long-term government bonds in the U.S. U.S. 10-year treasury bond yields moved above 1% for the first time since last March.

The World Bank’s January 2021 Global Economic Prospects report forecasts global economic growth of 4.0% in 2021, following the 4.3% contraction in 2020. The World Bank lowered the GDP growth targets for about half of the countries worldwide. The latest 2021 global forecast was revised from its earlier 4.2% growth target.

In Japan, Prime Minister Yoshihide Suga declared a state of emergency in Tokyo and the surrounding prefectures and is expected to last one month.

The UK imposed a third national lockdown in England. Also, all passengers arriving in the UK will now have to prove they do not have COVID-19 and receive a negative test result within 72 hours of the start of their journey.

Germany extended tough restrictions until the end of January. France to keep bars, restaurants, gyms, and theatres closed until at least February, while a senior medical expert did not rule out a third national lockdown.

The European Medicines Agency approved a second coronavirus vaccine, one developed by Moderna, for EU use.

Bitcoin once again accelerated to a record high of $37,400.

What We Can Expect from the Market this Week

Last week’s positive gains were a reminder that the market now is focusing on a long-term view, and not the news cycle. In a week when the logical market response may have presumably been more negative, the equity markets saw a strong start to the year globally, with major indexes hitting fresh record highs, signalling optimism around the outlook for the post-vaccine phase.

Heightened prospects for significant fiscal stimulus under the incoming Biden administration also appeared to be the major factor driving to the week’s gains.

The week marks the unofficial start to the earnings season, with several national and regional banks reporting quarterly earnings. Also, important economic news released this week including JOLTs Job Openings on Tuesday, CPI and Federal budget on Wednesday, unemployment claims and export/ import prices on Thursday, and PPI, retail sales, business inventories, industrial production and capacity utilization on Friday.