PAST WEEK'S NEWS (May 10 – May 16, 2021)

Stocks Performance (U.S. Stocks)

Global equities finished the week in negative territory after hot inflation data upset the market mid-week, before rebounding some later in the week. The markets weakness concentrated in technology and high-growth stocks. The catalyst for the pullback was the release of the April CPI on Wednesday, which rose 4.2% from a year ago and 0.8% from March. The directional change in prices was hardly a surprise to economists and investors, but the magnitude of the increase was well above expectations.

The dip could have been a lot worse, but several investors used the weakness as an opportunity to buy with a little help from several factors, including; 1) A retracement in long-term interest rates, signalling that the Treasury market wasn't concerned about inflation even after receiving additional hot inflation data apart from the CPI report; 2) The CDC saying fully vaccinated people can engage in most activities without masks; and 3) A view that the market was oversold on a short-term basis and was likely due for a bounce.

Advancing sectors were led by Industrial Services sector at 0.52%, followed by Communications at 0.51%, Consumer Non-Durables (0.35%), and Finance at -0.25%. Meanwhile, the weakest sectors were from the Consumer Durables sector at -5.80%, followed by Retail Trade at -3.21%, Commercial Services (-3.06%), and Electronic Technology sector (-2.95%).

Indices Performance

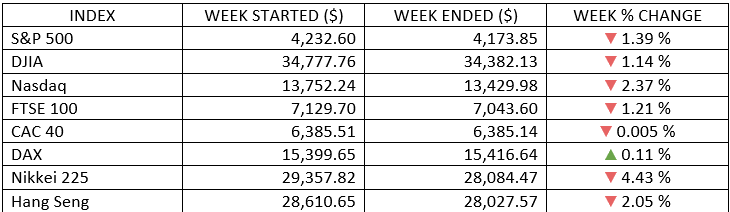

Stocks slipped back from record highs as investors confronted stark signs of higher inflation, but a late rally moderated the week’s declines. The S&P 500 and Dow Jones Industrial Average declined closer to 1%, while the Nasdaq Composite was the week's loser with losses over 2.0%.

Shares in Europe fell with global markets amid signs of accelerating inflation, stoking fears that interest rates could increase. Germany’s Xetra DAX and France’s CAC 40 were little changed, but the UK’s FTSE 100 pulled back 1.21%, in part because the British pound appreciated relative to the U.S. dollar after local election victories for the ruling Conservative Party. The FTSE 100 Index tends to fall when the pound rises because many companies in the index are multinationals that generate a meaningful proportion of their revenue abroad.

Japan’s stock markets registered sizable losses for the week following the accelerating coronavirus infection rates and the announcement that a state of emergency will be declared in three more prefectures also dampened risk sentiment, apart from the bout of volatility following an unexpectedly sharp rise in the U.S. CPI.

Oil Sector Performance

The gasoline and crude oil prices hit a 2-year high on Monday after the Colonial Pipeline was shut following a ransomware attack but eased at the end of the week after OPEC boosted estimates for the call on its output.

Market-Moving News

Market Pulled Back

Inflation concerns loomed over the market much of the week as the S&P 500 and the Dow both fell more than 1%. The NASDAQ dropped more than 2%. Although the week’s overall declines weren’t huge, the market’s path was choppy, with big declines on the first three days of the week that sent the NASDAQ down a total of 5.2%. Before stocks turned positive on Thursday and Friday, the Cboe Volatility Index briefly climbed to its highest level in more than two months.

Value's Comeback

Large-cap U.S. value stocks again extended their run of year-to-date outperformance versus their large-cap growth counterparts, beating them for the fourth week in a row. A value stock benchmark slipped about 0.7% while a growth benchmark fell about 2.0%.

Price Spike

Bond yields rose and the major U.S. stock indexes fell more than 2.0% on Wednesday after a report showed that consumer prices surged by the most in any 12-month period since 2008. Amid the economic recovery from the pandemic, the government’s CPI jumped 4.2% for the 12-month period that ended in April.

Retail Flattens

The recent spike in U.S. retail sales paused in April as the boost to consumers from government stimulus checks faded. The unchanged reading in retail sales last month followed a 10.7% surge in March.

Fed Chatter

In the wake of April’s spike in CPI, comments from U.S. Fed policymakers reiterated their belief that they don’t see any short-term need to depart from currently accommodative monetary policies.

Earnings Catalyst

With earnings season now almost over, the earnings growth rate could end up as the fastest for any quarter in 11 years, according to FactSet. As of May 10, Q1 earnings of companies in the S&P 500 were up more than 49% from the same period a year earlier―more than double the 24% rate that analysts had projected at the end of March.

Bitcoin Slump

After rising above $63,000 in mid-April, the price of bitcoin fell below $50,000 on Wednesday and Thursday. The cryptocurrency sustained a 13% drop on Wednesday; nevertheless, bitcoin remained sharply higher than its year-end 2020 level of around $29,000.

Other Important Macro Data and Events

The 10-yr yield increased six basis points to 1.64% from last Friday's settlement, but this was below the 1.70% settlement on Wednesday. The dollar edged higher for the week. Against a basket of major currencies, the index rose 0.09% to stay at 90.304. EUR/USD slipped -0.13%, USD/JPY added 0.71%, and GBP/USD rose 0.78%.

Federal Reserve officials made repeated assurances that the inflation data would not prompt any sudden shift in monetary policy. On Wednesday, Fed Vice Chair Richard Clarida acknowledged being surprised by the morning’s data, but he stated that a temporary surge in inflation remained “entirely consistent” with the Fed’s goals. Lael Brainard and Mary Daly, two other central bank officials, also stressed that the economy remained far from the Fed’s employment goals.

Labor Department reported that core CPI jumped by 0.9% in April, the most in nearly four decades and roughly triple consensus estimates. The headline CPI rose 4.2% over the 12 months ended in April, exceeding forecasts for a 3.6% increase. The PPI, reported Thursday, rose 0.6%, roughly double expectations.

However, the bigger-than-anticipated drop in weekly jobless claims to another pandemic-era low of 473,000. April retail sales, reported Friday, were flat for the month, but that followed a March sales surge that was revised higher, to 10.7%. The economy’s continued reopening was reflected in healthy gains in spending at bars and restaurants, and the Centers for Disease Control and Prevention surprised many by revising its guidance to say that fully vaccinated people do not need to wear face masks or socially distance in most circumstances indoors.

In cryptocurrencies development, Elon Musk’s announcement that electric vehicle maker would no longer accept Bitcoin as payment because of its carbon footprint sparked a sell-off in the cryptocurrency.

Core eurozone bond yields rose. A higher-than-expected inflation print in the U.S. triggered a sell-off in high-quality government bonds, causing core yields to rise in tandem with U.S. Treasury yields. Peripheral eurozone bonds largely tracked the moves in core markets. Fears of the ECB slowing bond purchases also pushed yields higher. UK gilt yields also tracked U.S. Treasury yields amid global weakness in government bonds.

The EC revised its economic growth forecasts to 4.3% for 2021 and to 4.4% for 2022—an increase from previous estimates of 3.8% in both years. Rising vaccination rates, the prospect of lockdowns easing across the region, and improving export demand prompted these upward revisions.

UK GDP in March grew a stronger-than-expected 2.1% sequentially, led by the reopening of schools, vaccine rollouts, and pickups in the retail and construction sectors. The expansion helped reduce the rate at which the economy contracted in the first quarter to 1.5%. Bank of England Governor Andrew Bailey said the central bank is watching the inflation situation carefully but does not think that the factors driving up consumer prices will last.

What Can We Expect from the Market this Week

It'll be interesting to see how the growth/technology stocks perform moving forward when money has been flowing into the cyclical/value stocks on reopening/inflation expectations and analysts have been calling for sustained underperformance. Many growth stocks are down substantially from their peaks in February.

The supply shortages and a reopening surge in demand are pushing prices higher. The current imbalances between supply and demand reflect pandemic distortions and thus are likely to prove temporary. We are closely watching consumer inflation expectations and wage growth to gauge whether price pressures will persist beyond this summer.

Important economic data being released this week including the housing market index, housing starts and existing home sales, leading indicators, weekly unemployment claims and the PMI index.