PAST WEEK'S NEWS (Nov 22 – Nov 28, 2021)

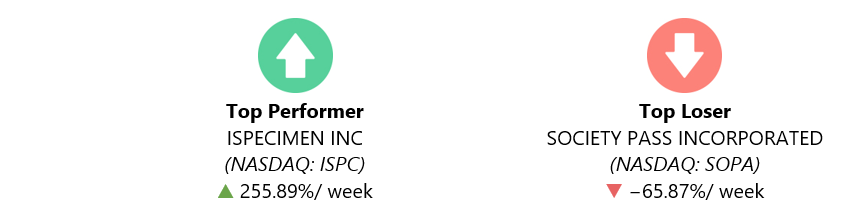

ISpecimen Inc value rocketed for the week after the company announcing contract for COVID-19 research. ISpecimen announced it has been contracted to deliver human biospecimens for advanced research on COVID-19, seeking insights on its transmissibility, variants, outcomes and testing validity among multiple population segments.

Stocks Performance

The major indexes in Asia, Europe, and the U.S. ended the week in red because of news of the highly mutated Omicron COVID-19 variant. The discovery of a new highly transmissible coronavirus variant in South Africa overturned what had been a fairly quiet week for financial markets, sparked worries over potential renewed lockdowns.

Before the variant news on Friday, the market was experiencing a rotation into value stocks from growth stocks amid growing expectations for the U.S. Federal Reserve to be more aggressive in tightening policy.

The release of FOMC minutes from the early November meeting on Wednesday showed that some officials wanted to end the Fed’s asset purchase program sooner than June 2022 in case they feel greater urgency to raise rates once the program wraps up. The Fed officials also expressed concern about the persistence of rising inflation and discussed whether they should prepare to raise interest rates in the first half of next year.

From a sector perspective, energy escaped with a gain, even though it fell on Friday. The industrial services sector also rose for the week. Other sectors closed lower, led by information technology, producer manufacturing, consumer discretionary, and retail trade, with losses over 3.0%.

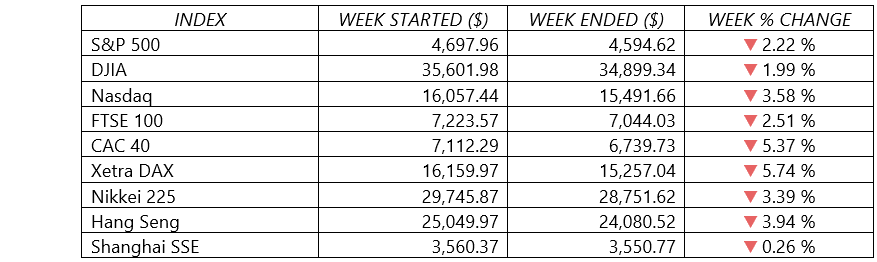

Indices Performance

Major U.S. indexes were dragged lower on holiday-shortened week, as Omicron variant takes down the market. A steep sell-off on Friday left U.S. large-cap stock indexes with weekly declines ranging from around 2.0% to 3.5%. The S&P 500 set an all-time high early in the week, before ended lower.

Shares in Europe were weighed as surge in COVID-19 cases is raising the prospect of lockdowns going into the Christmas shopping season. European countries expanded COVID-19 booster vaccinations and tightened curbs on movement. Austria reimposing nation’s lockdown, Slovakia announced a two-week lockdown, the Czech government will shut bars early. Germany crossed the threshold of 100,000 COVID-19-related deaths.

Japanese equities battled on gamely for much of the shortened week, only to succumb late in the week as worries about the pace of economic recovery ultimately undermined sentiment.

The Chinese Shanghai Composite Index ending flat amid U.S.-China tensions and rising economic pressures that raised expectations for supportive government measures. Relations with the U.S. remained tense over the status of Taiwan and trade issues. The U.S. Commerce Department issued a trade blacklist naming a dozen Chinese companies that it said supported the military modernization of the People’s Liberation Army. In response, a Chinese official said the U.S. should not expect China’s military to compromise regarding Taiwan.

Crude Oil Performance

Fears stemming from the new coronavirus variant and the move by the U.S. and other consumer nations releasing oil from strategic petroleum reserves (SPR) dragged the crude oil market lower, for the fifth consecutive week.

News of the highly mutated COVID-19 variant sent U.S. crude oil prices down 12% on Friday. The price fell to around $69 per barrel—the lowest level in more than 2-1/2-month—as several nations banned air travel from countries in Southern Africa in hopes of containing the variant’s spread.

The U.S. President Joe Biden's administration meanwhile moved to release millions of barrels of oil from strategic reserves in coordination with other large consuming nations, including China, India, and Japan, to try to lower energy prices.

The U.S. will release 50 million barrels of crude from its strategic reserves in concert with China, Japan, India, South Korea, and Britain. Of that amount, 32 million will be released from the U.S. SPR as an exchange over next several months, while 18 million will come from an accelerated release from previously authorized sales, the White House said in a statement Tuesday. At 50 million barrels, the action represents one of the largest-ever release from U.S. reserves, eclipsing past interventions that saw the U.S. putting 30 million barrels onto the world market at time of Libyan unrest in 2011 and Operation Desert Storm in 1991. Under an SPR swap, oil companies take crude oil from the stockpiles but are required to return it - or the refined product - plus interest.

India reportedly adding another 5 million barrels from its emergency stockpiles and the UK contributing 1.5 million barrels. Announcements are also expected from China, Japan, and South Korea, which together could add anywhere between 10 million and 20 million barrels.

Biden has been under increasing pressure to stem rising energy prices that threaten to undermine the economic recovery from the pandemic. OPEC+ earlier snubbed his request for a large production increase and instead raised output by just 400,000 barrels per day for December. The OPEC group is due to hold discussions on Dec 2, to decide whether it will continue with the production output plan.

Meanwhile, global powers and Iran will meet on Monday to revive talks on a nuclear deal that could lift U.S. sanctions on Iranian oil, allowing Tehran to increase exports.

Other Important Macro Data and Events

President Biden nominated Federal Reserve Chair Jerome Powell to serve a second four-year term as head of the nation’s central bank, lifting expectations of policy stability as the Fed seeks to contain rising inflation. The nomination is widely expected to be approved by the Senate, and Powell’s new term would begin in February 2022.

Comments from other members of the FOMC about the potential to accelerate the tapering of the Fed’s bond purchases contributed to the less dovish outlook for Fed monetary policy and helped push Treasury yields higher. The minutes from the November FOMC meeting, released on Wednesday, also showed that some policymakers advocated for a quicker taper.

The yield of the 10-year U.S. Treasury bond was pushed up to 1.65% on Wednesday. The dollar index, which measures the greenback against six peers, edged lower from Wednesday's 96.938. However, it was up 0.73% on the week, recorded its fifth straight weekly gain.

Economic data were positive for the week - The number of Americans applying for unemployment benefits fell to the lowest weekly total since 1969, marking the eighth consecutive weekly decline. The 199,000 filings in the latest weekly count were down from 270,000 the previous week and was far below economists’ expectations. Fed's preferred inflation gauge in the PCE Price Index was up 5.0% YoY in October.

Core eurozone bond yields ended roughly flat after the coronavirus news dragged them off the week’s highs. However, peripheral eurozone bond yields stayed higher on inflation and the prospect of central banks tightening their policies, as did UK gilts.

The UK banned travel from South Africa and its neighbors to contain the new strain of coronavirus, with the EU expected for similar moves.

What Can We Expect from the Market this Week

Investors will come back from the weekend looking to determine if the market sell-off tied to a new COVID variant is overdone or if the pandemic recovery timeline is being pushed back. The selling pressure was not limited to travel and leisure stocks, as a risk-off trade swept over the tech sector, electric vehicle names and cryptocurrencies as well. It will be a busy week with a key OPEC meeting on the calendar and the November jobs report due out on Friday.

A monthly labor market update due out on Friday is likely to be the week’s most closely watched economic report. The data will show whether November maintained the pace of job growth seen in October, when the economy generated 531,000 new jobs—the biggest gain in three months—and unemployment fell to 4.6% from 4.8%.

Another important economic data being released this week include the consumer confidence index and the PMI index.