PAST WEEK'S NEWS (Feb 14– Feb 20, 2022)

HOOKIPA soared for the week after the company announced it has entered into an amended and restated collaboration and license agreement with Gilead Sciences to advance the development of a novel arenaviral immunotherapy as a component of a potential functional curative regimen for HIV. Under the amended agreement, HOOKIPA is responsible for advancing the HIV program through the end of a Phase 1b clinical trial, with funding from Gilead via an upfront payment. HOOKIPA will receive a $15 million upfront fee with the amended agreement. It will also receive a $5M equity payment investment from Gilead and up to $30M in additional equity financing.

Stocks Performance

Equity markets struggled to find direction this past week as tensions between Russia and Ukraine continued to take center stage, driving market volatility and a flight to safe-haven assets. These geopolitical tensions come on top of a market already grappling with elevated inflation and rising Fed rate-hike expectations.

Conflicting signals on whether Russian troops were preparing to cross the border with Ukraine appeared to whipsaw markets throughout the week. Stocks fell on Monday afternoon following a CNN report that the president of Ukraine, Volodymyr Zelensky, said the government had been informed that the coming Wednesday would “be the day of attack.” The indexes then rallied on Tuesday, after Russian President Vladimir Putin said he hoped for a diplomatic solution to tensions with the U.S. and its allies and announced a partial pullback of troops near the Ukrainian border. Stocks then reversed course and headed lower again on Thursday, after U.S. officials stated that there was no evidence of a pullback and that an invasion was “imminent.”

In addition to the geopolitical tensions, investors also continue to digest news around the Fed and the consumer. Particularly notable were the January FOMC meeting minutes and the monthly U.S. retail sales figure, both of which offered a bit of relief to markets.

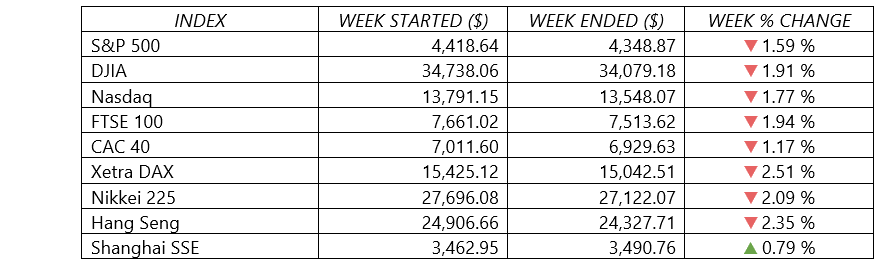

Indices Performance

For the second week in a row, the major U.S. stock indexes appeared to be on the verge of an overall gain at midweek, only to end up negative after declining on Thursday and Friday. The markets are scheduled to be closed on Monday, February 21, in observance of Presidents Day.

Shares in Europe also fell, with sentiment weighed down by geopolitical tensions in Ukraine and concerns about more aggressive monetary policy tightening by the Fed.

Chinese markets rose as supportive comments from government officials and lower-than-expected inflation data increased investors’ risk appetite. In a State Council meeting, China’s Premier Li Keqiang reportedly pledged that Beijing would swiftly roll out a slew of measures to provide stronger support to the economy, parts of which are still suffering from the effects of the coronavirus pandemic. Separately, China’s top finance minister vowed to further cut corporate tax rates, strengthen targeted fiscal spending, and tighten fiscal discipline, while PBO) said that the central bank would maintain supportive monetary policy this year.

Crude Oil Performance

Both benchmarks recorded their first weekly fall in nine weeks after hitting their highest points since September 2014.

The potential for additional oil exports from Iran helped to offset concerns related to supply disruptions stemming from the continuing Russia-Ukraine conflict. Talks to salvage Iran's 2015 nuclear deal entered their final stages, with related parties are said to be closer to an agreement, providing much-needed relief to global oil prices, as the possibility of new crude supplies reduces the supply-demand deficit.

Oil markets have been dominated in recent weeks by Russia's threatening posture toward Ukraine, with concerns that supply disruptions from the major producer in a tight global market could push oil prices to $100 a barrel. Russia is one of the world's largest oil producers, and is particularly important to the European region (supplying nearly 40% of natural gas to the region).

Other Important Macro Data and Events

Reports earlier last week stated that Russia had pulled back troops from the Ukrainian border after completing military drills – a de-escalation that was welcomed by markets broadly. However, later in the week, the U.S. and NATO officials reported that Russia had not moved troops. In fact, U.S. officials claimed that Russia had increased its troop presence on the Ukrainian border by thousands, and a military attack may remain imminent in the days ahead. U.S. and NATO allies, including the European Union, stand prepared to deliver "swift and severe" sanctions against Russia if it were to move forward with military action.

Later this week, U.S. Secretary of State Blinken plans to meet Russian Foreign Minister Lavrov in Europe to engage in further diplomacy, assuming no military escalation has occurred.

The unclear signals from Russia, the Fed, and the economic reports kept Treasury yields fluctuating over the week. The yield of the 10-year U.S. Treasury climbed as high as 2.06% on Wednesday (the highest since July 2019) before slipping down to around 1.93% on Friday. As recently as mid-December 2021, the yield was as low as 1.40%.

The Fed minutes for the January FOMC meeting were relatively benign, provided some relief to markets, as they contained no material surprises or overly hawkish commentary. The minutes indicated that while the Fed was generally ready to raise rates in March, it did not particularly favor a 0.50% rate hike or any other overly aggressive move. However, the committee noted that a substantial reduction in the Fed balance sheet seemed appropriate.

Meanwhile retail sales for January came in well ahead of expectations, despite omicron worries. U.S. retail sales rebounded from a decline in December, as a surge in online purchases and increased sales of furniture helped to fuel better-than-expected growth in January. High inflation also helped to boost the latest monthly retail sales total, which was up 3.8%, compared with December’s 2.5% decline.

Two economic releases indicated potential weakness in the U.S. economy. The latest weekly tally of new claims for unemployment benefits rose to 248,000, marking the first increase in four weeks. Meanwhile, a monthly report on a basket of leading economic indicators showed a deceleration in the overall growth rate after having stabilized for several months.

In Europe, core eurozone bond yields fluctuated but ended lower overall, as fears of a Russian invasion of Ukraine intensified. Peripheral eurozone and UK government bond yields broadly tracked core markets. ECB President Christine Lagarde and Governing Council members Francois Villeroy de Galhau and Pablo Hernandez de Cos emphasized that any adjustment to monetary policy would be gradual and guided by key economic data.

UK inflation reached a 30-year high in January and the labour market tightened further, contributing to increased expectations for the BoE to announce a third consecutive interest rate increase in March. CPI rose 5.5% in January—the highest level since March 1992—and up from 5.4% in December.

Amid inflation concerns and rising geopolitical conflict, the price of gold climbed to its highest level in about eight months. The price of gold futures briefly eclipsed $1,900 on Friday, marking a 6% increase from a recent low in late January.

What Can We Expect from the Market this Week

The stock market is likely to face more twists and turns in the Russia-Ukraine drama, adding to investor anxiety over the pace and impact of interest rate hikes and inflation trends in the weeks ahead.

On the economic calendar, the second estimate of Q4 GDP is expected to see an upward revision. Another important economic data released will also include updates on new home sales, durable goods orders, consumer spending and consumer income, and weekly unemployment claims.

For corporate reports, earnings are due in from include Alibaba, Home Depot, Lowe's, Macy's, eBay, Dell Technologies and Block.

The oil market will also be in the spotlight next week as Russia-Ukraine developments play out and the prospect of higher production out of Iran is weighed.