PAST WEEK'S NEWS (April 4– April 10, 2022)

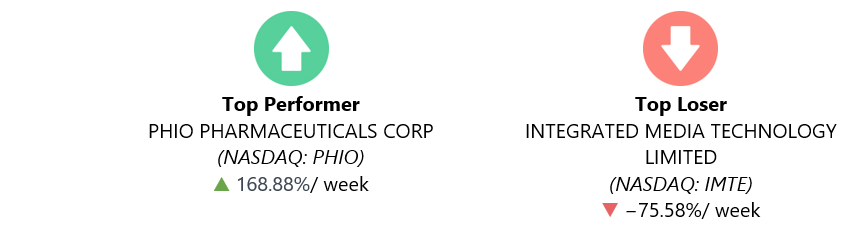

Shares of microcap Phio Pharmaceuticals had shot up by over 150% on Thursday and Friday after the company data demonstrating antitumor efficacy in its preclinical data. PHIO is a clinical stage biotechnology company developing the next generation of immuno-oncology therapeutics based on its self-delivering RNAi therapeutic platform.

Stocks Performance

The major indexes finished lower for the week, with small-caps and growth stocks lagging considerably, under pressure in an environment of rising interest rates.

Front and centre were the release of the Fed March meeting minutes, which laid out plans for a speedier policy tightening. The minutes revealed that policymakers were prepared to reduce the central bank’s balance sheet by $95 billion per month, more than the consensus expectation of around $80 billion. The minutes also showed that officials were prepared to raise rates by 50 basis points at their upcoming May meeting.

The situation in Ukraine continued to loom large over sentiment. The additional sanctions on Russia levied by the global community further escalated concerns about inflation weighing on risk assets.

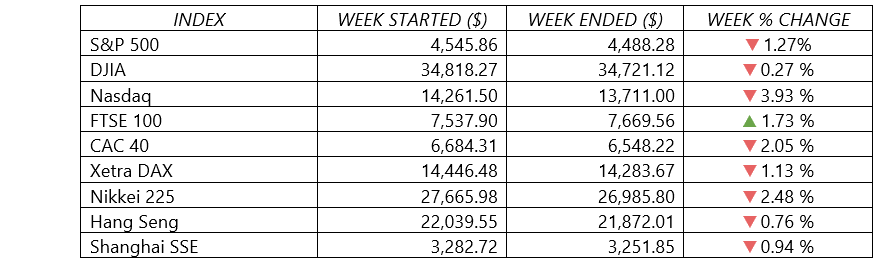

Indices Performance

The major U.S. indexes gave back some of the gains they recorded in March, as stocks pulled back after a strong start to the week. The Nasdaq extended its run of year-to-date underperformance relative to the other major U.S. indexes, as it fell by nearly 4% for the week.

Europe’s main continental stock indexes were also lower, with France’s CAC 40 Index fell more than 2% on election uncertainty, with polls showing a significant narrowing of President Emmanuel Macron’s lead over far-right contender. The UK’s FTSE 100 Index meanwhile advanced 1.7%.

Chinese markets eased as a coronavirus lockdown in Shanghai and expectations for aggressive monetary tightening by the U.S. Federal Reserve curbed risk appetite. Shanghai has been under a citywide, two-stage lockdown that began on March 28 in an effort to stop the virus’s spread. With 23 Chinese cities currently under total or partial lockdown, it is estimated that 193 million people are affected in areas that account for 13.5% of China’s economy.

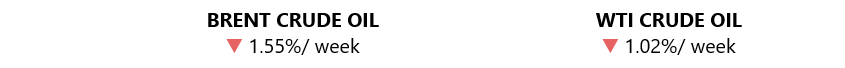

Crude Oil Performance

Crude oil prices fell for the second week in a row, with the U.S. WTI slipping below the $100-per-barrel level on Tuesday and ending the week around $98. Despite the recent pullback, the price remained about 30% above its level at the end of 2021.

Oil drifted lower after consuming countries agreed to release 240 million barrels of oil from emergency stocks to help offset disrupted Russian supply. The IEA on Thursday confirmed member country contributions to the second collective action to release oil stocks. The commitments submitted by members reached 120 million barrels to be released over a six-month period, the IEA added, with major contributors include South Korea, Germany, France, Italy and the United Kingdom. Meanwhile the U.S. will release 60 million barrels of oil from storage and Japan will release 15 million barrels.

Investors are also assessing the fundamentals in the oil market amid uncertainties over slowing demand in China, where cities have been under lockdown due to the latest wave of COVID-19 infections, and the loss of supplies from Russia.

Other Important Macro Data and Events

The yield of the 10-year U.S. Treasury bond rose on Friday for the sixth consecutive trading session, jumped 34 basis points to 2.71%, the highest in three years. The jump from 2.38% at the end of the previous week resulted in a quick end to a yield curve inversion that occurred on April 1, when the yield of the 2-year Treasury rose above the yield of the 10-year bond.

The brief inversion in that segment during intraday trade last Friday had raised concerns of a looming recession. However, the five-year/30-year curve segment—also considered by many investors to be a recession indicator—remained negatively sloped.

The outsized rise in Treasury yields also has seen the dollar index top 100 for the first time since May 2020.

Core eurozone bond yields also climbed in tandem with U.S. Treasury yields. The imposition of additional sanctions on Russia and expectations that the U.S. Fed would tighten monetary policy aggressively sparked a sell-off in core bonds.

The week’s economic calendar was relatively light but arguably suggested that the economy was proving resilient in the face of inflation and the war in Ukraine. Most notably, weekly jobless claims fell much more than expected to 166,000, down 5,000 from the previous week, the lowest weekly figure since 1968. Continuing claims rose unexpectedly, however. The Institute for Supply Management’s gauge of service sector activity came in slightly below consensus expectations but still indicated robust expansion.

Wednesday’s release of minutes from the U.S. Federal Reserve’s mid-March meeting showed that policymakers discussed the possibility of raising the Fed’s benchmark interest rate by a half-percentage point at a meeting scheduled early next month.

Minutes of the ECB’s meeting were also more hawkish, as it revealed that many policymakers believed that the persistence of high inflation called for immediate steps toward normalizing monetary policy to prevent a wage-price spiral. Some argued for winding down the central bank’s asset purchase program by the summer and noted that conditions for lifting interest rates had either been met or would soon be met. However, other members preferred a wait-and-see approach, citing the exceptionally high uncertainty created by the conflict in Ukraine.

Gold managed a weekly gain of 1.1% but has been undermined by the huge rise in bond yields and stronger dollar.

What Can We Expect from the Market this Week

The week ahead will mark the beginning of the Q1 earnings season, with big banks such as JPMorgan Chase, Goldman Sachs and Wells Fargo heading into the earnings confessional.

The economic calendar meanwhile will be headlined by the highly anticipated inflation report on Tuesday, on whether the U.S. economy got any relief in March from surging inflation. The CPI is expected to show inflation rising 1.1% in March on a month-to-month comparison and 8.4% from a year ago. That's an acceleration from the pace seen in February.

Updates on PPI, retail sales and consumer sentiment are also due in next week. Federal Reserve speakers will also make the circuit as investors continue to eye the pace of rate hikes, latest developments in the hawkish U.S. monetary policy.