PAST WEEK'S NEWS (October 14 – October 18, 2024)

British inflation fell drastically in September, dropping to 1.7% from 2.2% in August, the lowest level since April 2021, driven by lower airfares and petrol prices. It was more pronounced than economists had predicted, leading to an eventual decline in sterling against the dollar and euro. This ease has increased the likelihood of interest rate cuts by the Bank of England, with investors now anticipating two quarter-point cuts by year-end. Core inflation and services inflation, key indicators closely monitored by the Bank of England, also fell more than expected, further supporting the case for monetary policy easing. The inflation data provides a favourable backdrop for Finance Minister Rachel Reeves as she prepares to present her first budget on October 30, potentially offering more flexibility in addressing public services and infrastructure investments.

The economy is looking to be better than necessary for another rate cut after the US retail sales report came in at 0.4% in September, more than 0.3% expected. This follows August's 0.1% rise, with healthy spending on groceries and clothing offsetting weakness in furniture and electronics purchases. The Federal Reserve is considering these figures as they prepare for their November policy decision, following a 50-basis point rate cut in September. Initial jobless claims for the week declined to 241,000, matching market expectations. These high impact data suggest a stable US economy with steady consumer spending and labour market conditions. However, upcoming economic indicators, including third-quarter GDP, inflation readings, and the October jobs report, will be key factors in the Fed's next interest rate decision.

INDICES PERFORMANCE

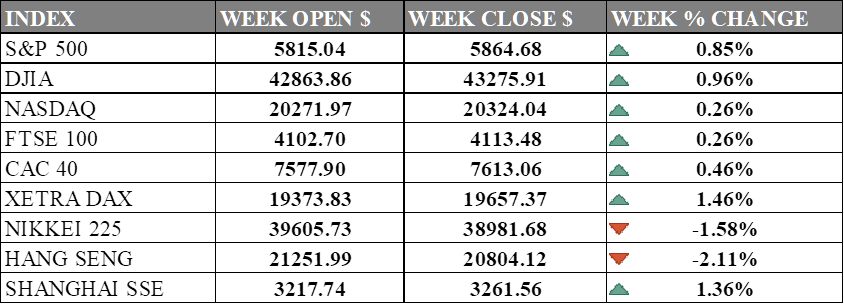

Wall Street recorded slight gains this week, with all major US indices showing notable upticks. The S&P 500 rose 0.85% to close at 5,864.68. The Dow Jones Industrial Average saw a healthy increase of 0.96%, finishing at 43,275.91, while the tech-heavy Nasdaq climbed 0.26% to close at 20,324.04. Even though broad market is still positive, U.S. semiconductor stocks are under scrutiny following mixed industry reports, with upcoming earnings from Texas Instruments and AMD expected to provide insight into AI demand and market trends.

European markets also experienced positive movements, albeit to varying degrees. The UK's FTSE 100 gained 0.26%, closing at 4,113.48. France's CAC 40 saw a modest 0.46% increase, closing at 7,613.06. Germany's DAX outperformed its European counterparts, rising 1.46% to end at 19,657.37. These gains indicate a generally positive week for European markets, aligning more closely with the performance of US indices.

Asian markets presented a mixed picture, with stark divergences between different regions. Japan's Nikkei 225 saw a considerable decline, falling 1.58% to 38,981.68 possibly due to lower inflation printed. Chinese markets showed a mixed performance, with Hong Kong's Hang Seng Index posting a loss of 2.11%, closing at 20,804.12. However, the Shanghai Composite in mainland China experienced a notable gain, rising 1.36% to close at 3,261.56. These contrasting movements suggest diverging economic outlooks and investor sentiments across Asian markets, with Chinese mainland markets showing strength while Japanese and Hong Kong markets faced headwinds.

CRUDE OIL PERFORMANCE

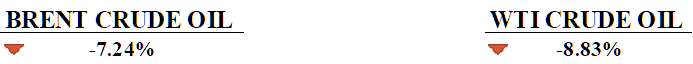

This week Brent crude oil prices dropped 7.24%, settling at $73 per barrel while WTI at 8.83% at $68 per barrel. The decline was mainly driven by reduced demand forecasts from OPEC and the IEA, along with concerns over China’s slowing economic growth. China's refinery output has fallen for the sixth consecutive month, due to weaker fuel demand and the rise of electric vehicle adoption. U.S. crude oil production hit record levels, although price support came from a decline in U.S. crude inventories and better-than-expected retail sales. Geopolitical concerns remain, particularly surrounding the Israel-Iran conflict, although diplomatic efforts suggest tensions may ease overtime as long as there is no attack on key iran oil facilities. Overall, the oil market is facing downward pressure from both economic and geopolitical factors.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. budget deficit reached $1.833 trillion for fiscal year 2024, the third-largest in history, driven by increased spending on Social Security, healthcare, and defence, along with rising interest costs on federal debt. While U.S. receipts hit a record $4.919 trillion, interest on the debt exceeded $1 trillion for the first time.

China's economy grew 4.6% in the third quarter of 2024, remains burdened by a struggling property sector and weak domestic demand. Recent stimulus measures seem promising but concerns regarding long-term structural issues lingers, and experts express caution that further policy support is needed to stabilize growth.

What Can We Expect from The Market This Week

BoC Interest Rate Decision: The Bank of Canada is expected to cut its key policy rate by 50 basis points to 3.75%, marking its fourth consecutive cut aimed at stimulating economic growth. Economists predict weaker economics as consumer spending remains low and growth has stalled.

US Durable Goods Orders: New orders for manufactured durable goods in September are virtually unchanged to $289.7 billion, the U.S. Census Bureau announced. This followed a 9.9% July increase. Electrical equipment and transportation equipment are driving the slight increase. Excluding defence, new orders fell 0.3%, while shipments declined by 0.5%.

BRICS Summit: The upcoming BRICS summit in Kazan will gather world leaders, including Russian President Vladimir Putin, to discuss topics like a BRICS-led payment system and geopolitical conflicts, aiming to challenge Western influence. Russia views the summit as a diplomatic success, seeking to demonstrate its strong global alliances despite Western sanctions over the Ukraine conflict.

US Existing Home Sales: In September, home sales dropped 0.5% from August and 3% year over year, reaching a seasonally adjusted annual rate of 4.02 million, with Florida sales particularly impacted by Hurricane Helene. Even with falling mortgage rates, housing markets face difficulties from storm damage, lender reinspections, and rising interest rates, though pending sales rose by 2.5% from August.

Canada Retail Sales: Statistics Canada reported that retail sales in Canada rose 0.9% to C$66.4 billion in July, mainly by higher car sales and growth in motor vehicle and parts dealers. Core retail sales, excluding gas stations, fuel vendors, and motor vehicle-related sales, increased by 0.6%, with a preliminary estimate indicating a further 0.5% rise in August.