PAST WEEK'S NEWS (July 21 – July 25)

Tesla's Q2 2025 hit a roadblock, with earnings down 23% year-over-year and operating income falling 42%, with nearly half coming from regulatory credits rather than core operations. CEO Elon Musk redirected focus to Tesla's robotaxi rollout, aiming to cover half the U.S. population by year-end, starting with services in Austin and upcoming expansions in the Bay Area, Arizona, and Florida. Musk cautioned investors about "a few rough quarters" ahead but expressed confidence in Tesla’s future as an AI and robotics company, predicting it could become the most valuable company in the world. Tesla highlights advancements in its Optimus humanoid robot, with production targets of 100,000 units per month within five years. The company began producing more affordable EVs in early 2025 and expects continued growth in its energy storage segment. Plans for a third Megafactory in Houston.

More companies are jumping on the Bitcoin bandwagon, with the latest one being Trump's media company, which just dumped about $2 billion into Bitcoin, accounting for two-thirds of their liquid assets. In fact, this approach went from 79 public companies holding Bitcoin to 125 in just one quarter, sitting on over 847,000 Bitcoin worth about $91 billion total. MicroStrategy is still the king in this space with over 600,000 Bitcoin worth more than $72 billion, and their stock is up over 3,500% since 2020, although it is their main business to turn debt into crypto. Trump Media's stock popped 5.6% when they announced their buy, and with Bitcoin hitting new highs above $118,000, it's a no-brainer move that anyone could copy. It's not just about making money, though – companies see Bitcoin as protection against inflation and a way to avoid getting cut off from traditional banking if they fall out of favour. With Trump back in office signing crypto-friendly laws and talk of a national Bitcoin reserve, expect way more companies to follow suit since the corporate world is realising Bitcoin isn't going anywhere.

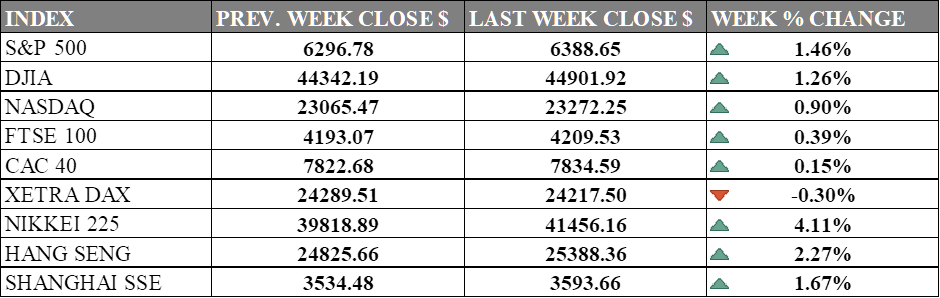

INDICES PERFORMANCE

Wall Street major indices posting solid gains as market sentiment improved from trade talks. The S&P 500 rose by 1.46%, closing at 6388.65, reflecting growing optimism in the broader market. The Dow Jones Industrial Average (DJIA) delivered strong performance with a gain of 1.26%, finishing at 44901.92. The Nasdaq showed more modest but still positive performance among major US indices with a 0.90% increase, closing at 23272.25, as investors maintained confidence in tech stocks. Market is focused on rate decision later this week and Jobs market data earlier in the week.

European markets showed mixed but generally positive results during the period, with modest gains across most major indices. The UK's FTSE 100 rose by 0.39%, closing at 4209.53. France's CAC 40 posted a slight gain of 0.15%, ending at 7834.59, while Germany's XETRA DAX bucked the trend with a small decline of 0.30%, closing at 24217.50. European markets see progress in its trade talk but no conclusive outcome yet, with Germany maintaining focus on its economic growth data this week.

Asian markets displayed exceptionally strong performance with notable gains across the region. Japan's Nikkei 225 posted an impressive gain of 4.11%, closing at 41456.16, reflecting renewed investor confidence over new government. Hong Kong's Hang Seng Index delivered solid regional performance with a 2.27% surge, finishing at 25388.36, while mainland China's Shanghai Composite Index showed healthy strength with a 1.67% gain, ending at 3593.66, as both markets benefited from improved sentiment and supportive economic data.

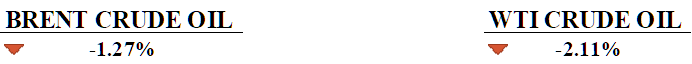

CRUDE OIL PERFORMANCE

Oil prices recovered from three-week lows on Monday after falling last week with brent losing 1.27% to $68.29 and WTI 2.11% lower to $65 with bulk of the action on Friday. The U.S.-EU trade deal managed to cut tariffs to 15% and secured $750 billion in EU energy purchases. Gains were limited by expectations that OPEC+ will proceed with planned production increases of 548,000 bpd in August and September, completing the unwind of 2.2 million bpd in voluntary cuts. Venezuelan crude that were allowed to operate recently could add further supply pressure if U.S. sanctions are eased, while Russia's gasoline export curbs and Middle East tensions provided geopolitical support. Markets now focus on OPEC+'s August 3 meeting to determine September output policy and the Fed's two-day meeting starting Tuesday for rate guidance. Key U.S. data this week includes the June PCE inflation index and July jobs report, which could influence Fed policy and oil demand outlook. Trade negotiations between the U.S. and China in Stockholm aim to extend the tariff truce before the August 12 deadline.

OTHER IMPORTANT MACRO DATA AND EVENTS

Jobless claims fell to a three-month low of 217,000, pointing toward a stable labour market although slower hiring leaves many unemployed struggling to find work.

European car sales fell 5.1% in June to 1.24 million, with major automakers like Volkswagen, Stellantis, Renault, Hyundai, and Tesla all seeing declines, while Chinese brands gained market share. EV and hybrid registrations surged, now making up nearly 60% of EU car sales as traditional automakers struggle with tariffs, regulations, and rising competition.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The bet is on another pause at the 4.25%-4.50% range until September, which is standing at a 60% chance of a cut, marking the fourth consecutive hold since December last year. Even with strong political pressure, the Fed stood steadfast due to inflation concerns from trade policy volatility.

BoC Interest Rate Decision: The Canadian central bank is expected to hold its overnight interest rate steady at 2.75%, which would be its third consecutive pause. Its economy took one of the hardest hits from U.S. trade policies. Analysts expect two more rate cuts by the end of 2025, potentially bringing rates down to the estimated neutral rate of 2.25%.

JOLTs Job Openings: The figures showed job openings jumped to 7.77 million in May, the highest in six months, signalling strength in the U.S. labour market. The next JOLTS report for June is scheduled for release on Tuesday, with analysts forecasting a cut to around 7.1 million openings.

China Manufacturing PMI: China's manufacturing stayed under the 50-point level, the latest being 49.7, continuing to contract for the third consecutive month, although it is rising from prior months. However, the Caixin/S&P Global manufacturing PMI, which focuses more on export-orientated and private firms, rose to 50.4 from 48.3 in May. This divergence shows an imbalanced recovery effort in China's industrial sector, which faces deflationary issues and weakened domestic demand.

BoJ Interest Rate Decision: The Bank of Japan is widely expected to maintain its short-term interest rate at 0.5% but may revise its economic assessment upward following the recent U.S.-Japan trade agreement that reduced a key source of uncertainty. A Reuters poll indicates most economists expect at least one 25 basis point rate increase by year-end.

Picture: Unsplash