PAST WEEK'S NEWS (October 21 – October 25, 2024)

Russia is hosting what it calls its "largest foreign policy event ever" in Kazan, bringing together 36 countries with over 20 heads of state, including leaders from China, India, and other major nations. The BRICS alliance, which has expanded from its original five members (Brazil, Russia, India, China, and South Africa) to include Iran, Egypt, Ethiopia, the UAE, and Saudi Arabia, now represents 45% of the global population, 37.4% of global GDP, and 45% of global oil reserves. Putin is positioning the summit as a strategic counterweight to Western influence, with key agenda items including the development of alternative payment systems to bypass SWIFT and reduce dollar dependency, though a common BRICS currency is still out of question. While Russia, China, and Iran align on anti-Western rhetoric, other members like India, the UAE, and Egypt maintain balanced relationships with both sides, leading some analysts to view the BRICS as a non-Western coalition rather than an anti-Western antagonist. The BRICS New Development Bank has already approved $32.8 billion in financing for 96 projects, demonstrating the alliance's growing economic influence and collaborations.

Tesla's latest earnings just came out, and it beat Wall Street estimates, with earnings per share of $0.72 and improved gross margins of 19.8%. The stock finished 10% higher after-hour since CEO Elon Musk predicted 20-30% vehicle sales growth next year and reported record-low production costs of $35,100 per vehicle. Vehicle deliveries grew 6% to 462,890 units, while revenue rose 7% to $25.2 billion and profit increased 17% to $2.2 billion. The company plans to launch cheaper models in early 2025, maintaining its position as the only profitable pure EV maker. Beside scepticism over its Robotaxi announcement, Tesla confirmed the Cybertruck is now profitable and its core car business remains strong. Analysts view the results positively, noting Tesla's success in balancing its traditional auto business with future tech investments in autonomous driving and AI.

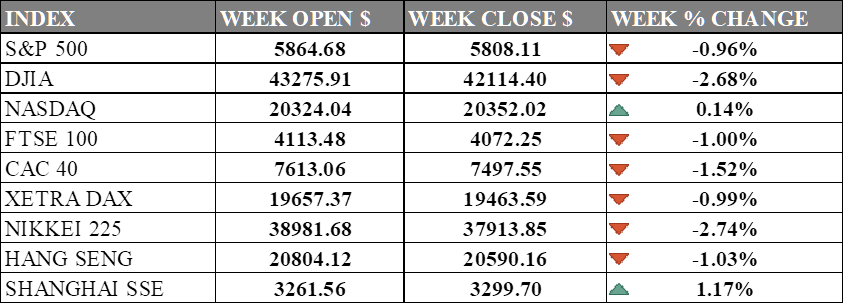

INDICES PERFORMANCE

Wall Street presented a mixed week, with tech holding onto gains while industrial dragged the main market. The S&P 500 close 0.96% lower at 5,808.11. The Dow Jones Industrial Average saw a decline of 2.68%, finishing at 42,114.40, while the tech-heavy Nasdaq climbed 0.14% to close at 20,352.02. Big tech is leading earnings season with 18% growth, while the broader S&P 500 remains flat and faces pressure from rising Treasury yields. Consumer sentiment is improving, but weak housing data and upcoming GDP and jobs reports keep market outlook uncertain.

European markets also experienced pressure, albeit to varying degrees. The UK's FTSE 100 fell 1.00%, closing at 4,072.25. France's CAC 40 saw a more substantial losses at 1.52%, closing at 7,497.55. Germany's DAX outperformed its European counterparts, falling only 0.99% to end at 19,463.59. These gains indicate a generally negative week for European markets, aligning more closely with the performance of US indices.

Asian markets presented a mixed picture, with stark divergences between different regions. Japan's Nikkei 225 saw a considerable decline of 2.74%, falling to 37,913.85, possibly due to lower inflation printed. Chinese markets showed a mixed performance, with Hong Kong's Hang Seng Index posting a loss of 1.03%, closing at 20,590.16. However, the Shanghai Composite in mainland China experienced a notable gain of 1.17%, rising to 3,299.70. These contrasting movements suggest diverging economic outlooks and investor sentiments across Asian markets, with Chinese mainland markets showing strength while Japanese and Hong Kong markets faced headwinds.

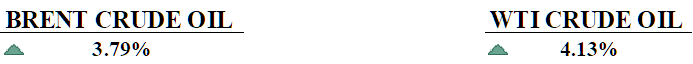

CRUDE OIL PERFORMANCE

Oil prices gained around 4% last week on hopes that hightening tension in middle east but Israel’s restrained response to Iran reduced immediate fears of a major supply crisis that pushed it back down. By avoiding critical oil sites, Israel left room for potential de-escalation, which brought crude’s risk premium down a few dollars. Traders saw this as a sign that energy supplies from the Middle East could stay stable, even if tensions remain. Weak demand from China is adding to the bearish sentiment, as low consumption undercuts prices. OPEC+ hasn’t stirred much movement either, with its output caps not making a dent in the current glut. Some analysts even suggest the market might be undervalued for now, hinting OPEC+ could hold off on planned production increases if prices stay down.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment reached a six-month high in October, driven by lower interest rates and increased optimism among Republicans about the upcoming presidential election. The University of Michigan's index hit 70.5, boosted by rising confidence among Republicans and independents, while Democrat sentiment dipped amid expectations of a close race.

U.S. new home sales climbed in September, marking their strongest level in over a year as lower mortgage rates drew in eager buyers. However, limited affordable housing options and uncertainty around future rates kept some potential buyers on the sidelines.

What Can We Expect from The Market This Week

US Nonfarm Payrolls: Jobs report jumped by 254,000 in September, lowering the unemployment rate to 4.1% and pushing the dollar index from 101.8 to 102.6. For the upcoming report, economists expect a smaller increase of 111,000 jobs, which could shape the Fed's approach to rate cuts in November.

JOLTs Job Openings: The number of job openings in the US reached 8.04 million in August, exceeding expectations and up from 7.71 million in July, according to the Bureau of Labor Statistics. For the next JOLTS report, job openings are projected to drop slightly to around 7.92 million.

US GDP Q3: The US economy for Q3 2024 is expected to stagnate, following a 3.0% revised growth in Q2. Key factors include increased borrowing costs limiting business investments and easing inflation trends, with the Federal Reserve likely to cut smaller in November.

China Manufacturing PMI: Manufacturing in China remained in contraction at 49.8 in September, showing a slight improvement but still seeing ongoing weakness in the sector, with only the production index returning to expansion. Similarly, the Caixin PMI fell across both manufacturing and services, reflecting declining new orders and lower domestic demand, creating concerns over labor costs and overall business confidence despite recent government stimulus measures.

US PCE Price Index: Inflation in the U.S. eased closer to the Federal Reserve’s target in August, with the PCE price index rising just 0.1%, bringing the annual rate down from 2.5% to 2.2%. Fed officials now shift their focus from combating inflation to supporting a labor market showing signs of softening.