PAST WEEK'S NEWS (March 31 – April 04)

President Trump’s announcement of a minimum 10% sweeping tariff on most imported goods, along with steeper levies on many trading partners, has ignited a global trade war that was limited to few countries just a week before. The measures unveiled from the White House Rose Garden immediately rattle global markets, with significant declines in Asian, European, and U.S. stock indices. Major economies like China and the European Union have vowed countermeasures, further escalating tensions. Critics warn that these tariffs will contribute to rising inflation, slow economic growth, and impose substantial costs on consumers and businesses worldwide. Domestic opposition is growing, with some lawmakers and advisors questioning the long-term benefits despite claims that the tariffs will help American manufacturing jobs.

Analysts and central banks might adjust their interest rate expectations amid growing fears of inflation and recession after new U.S. tariffs heightened global economic uncertainty. Deutsche Bank and others warn that the tariffs may trigger a crisis of confidence in the U.S. dollar, potentially prompting volatile currency trades and impacting global capital flows. The European Central Bank has already cut rates multiple times and left the door open for further easing, citing trade tensions and their potential to depress growth and inflation. However, the ECB also flagged short-term upside risks to inflation due to retaliatory tariffs and rising input costs. Meanwhile, the Federal Reserve faces a difficult balancing act as tariffs raise inflation while weakening the labour market and growth, prompting some analysts to predict up to five rate cuts this year despite near-term price pressures.

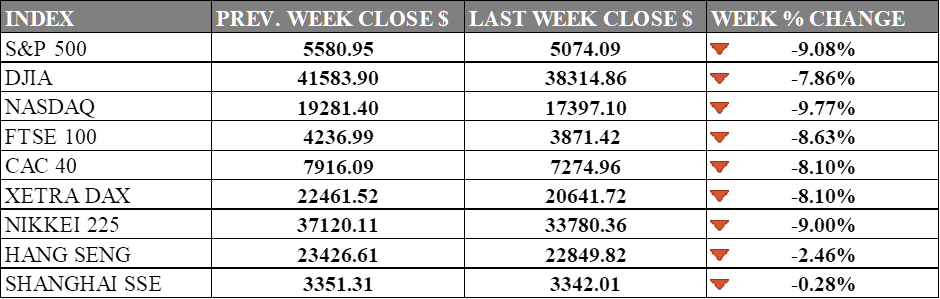

INDICES PERFORMANCE

Wall Street experienced a dramatic decline last week. The S&P 500 plunged by 9.08%, closing at 5074.09, reflecting significant broad market weakness. The Dow Jones Industrial Average (DJIA) saw a substantial loss of 7.86%, finishing at 38314.86, showing vulnerability amid market turbulence. Meanwhile, the Nasdaq suffered the largest decline of 9.77%, closing at 17397.10, as tech stocks faced severe pressure. This sharp correction goes well beyond typical market fluctuations, suggesting deeper concerns than simple profit-taking.

European markets mirrored the global selloff. The UK's FTSE 100 tumbled 8.63%, closing at 3871.42. France's CAC 40 experienced a significant decrease of 8.10%, ending at 7274.96, while Germany's XETRA DAX declined by the same percentage, closing at 20641.72. European markets appear to be reacting strongly to global economic concerns, with renewed trade tensions and monetary policy uncertainty serving as key risk factors.

Asian markets also showed pronounced weakness, though with varying intensity. Japan's Nikkei 225 posted a sharp loss of 9.00%, closing at 33780.36, despite previous expectations of a pause in the BoJ interest rate hike path. Hong Kong's Hang Seng Index showed more resilience but still weakened, falling by 2.46%, finishing at 22849.82. In mainland China, the Shanghai Composite Index declined only slightly by 0.28%, ending at 3342.01, showing relative stability compared to global peers despite ongoing trade tensions.

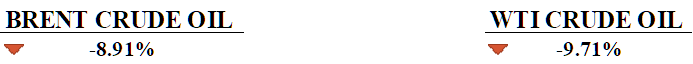

CRUDE OIL PERFORMANCE

Last week, crude oil prices plummeted to multi-year lows, with WTI closing at $62.27 and Brent at $65.95 per barrel, due to escalating U.S.-China trade war following President Trump’s sweeping tariffs and China’s retaliatory 34% levies on U.S. goods. Analysts, including UBS, project that the trade conflict could reduce global GDP growth, potentially slashing oil demand by 250-500 kb/d, while OPEC+ intensified supply-side pressures by announcing a 411,000 b/d production increase for May, seeing tolerance for lower prices with overproduction concerns. U.S. refiners’ shares, alongside companies like Apple and Nvidia with China exposure, hit near two-year lows due to anticipated weaker fuel demand and refining margins. Investors are increasingly betting on aggressive rate cuts from central banks, with the Federal Reserve expected to cut rates by 110 basis points by year-end, as Federal Reserve Chair Jerome Powell acknowledged the tariffs’ potential to drive higher inflation and slower growth. Despite positive U.S. job growth data for March, the overriding market sentiment remains bearish, fueled by the trade war’s threat to global trade stability and the oversupply from OPEC+.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. jobless claims dropped to 219K, below expectations, signalling a stronger labor market and potentially boosting the USD.

China's services sector grew more than expected in March, with the Caixin Services PMI rising to 51.9, driven by improved local demand and business activity from Beijing's stimulus measures.

What Can We Expect from The Market This Week

RBNZ Interest Rate Decision: The Reserve Bank of New Zealand is expected to cut interest rates to 3.50% in response to mounting concerns over the economic impact of the U.S.-China trade war and continuation of its easing fiscal policy, aligning with a broader trend of rate cuts by central banks worldwide.

FOMC Meeting Minutes: The minutes highlight the Federal Reserve’s cautious stance even with inflation slightly cooling due to economic uncertainty and tariff shocks, keeping interest rates steady, although recent flights to treasury may force their hands.

US CPI March: Inflation currently at 2.8% year-over-year is now expected to ease to 2.6% in March after coming in below expectations, offering some relief to markets and policymakers. However, ongoing tariff pressures and global economic uncertainties continue to cloud the outlook, keeping investors cautious about the months ahead.

UK GDP February: The UK economy in 2025 started bleak, with January GDP falling 0.1%, while consensus for positive February data came after signs of consumer and housing strength but tempered by inflation, trade risks, and uneven sectoral performance.

German CPI March: Inflation in Germany rose by 0.3% in March and 2.2% annually based on preliminary data, down from 2.3% in February and the lowest since November 2024. The slowdown was mainly due to reduced services inflation at 3.4% and a 2.8% year-on-year drop in energy prices.