PAST WEEK'S NEWS (June 26 – May 30)

After the TACO Trade cynicism, the market is in for another weary sigh. A federal appeals court decided to temporarily pause a ruling that blocked President Trump’s global tariffs, keeping the policy in limbo as legal proceedings continue. The ruling grants POTUS 10 days to reverse course, a decision he swiftly appealed. The U.S. Court of Appeals for the Federal Circuit issued a stay on Thursday, allowing the tariffs to remain under consideration pending further review. Trump has lashed out at the trade court and its judges, expressing hope that the Supreme Court will ultimately reverse the block while insisting the tariffs will generate trillions of dollars for the U.S. economy. The next hearing is scheduled for June 5, with expectations that the case will escalate to the Supreme Court for a final decision. Meanwhile, the White House has signalled it may bypass court losses by implementing the tariffs through alternative mechanisms.

One of the world’s most indebted developed economies recently influenced both its own and global bond markets when its Ministry of Finance proposed to reduce the issuance of super-long tenor debt, leading to yields on 40-year Japanese government bonds dropping from a record high of 3.675% and lowering U.S. Treasury 30-year yields below 5%. Analyst Michael Lorizio from Manulife Investment Management see Japan’s move as a test case for other indebted nations, showing how flexible debt issuance strategies might address fiscal challenges. The Bank of Japan continues its quantitative tightening plans unchanged, closely watching how it unfolds, being at the centre of global debt stability.

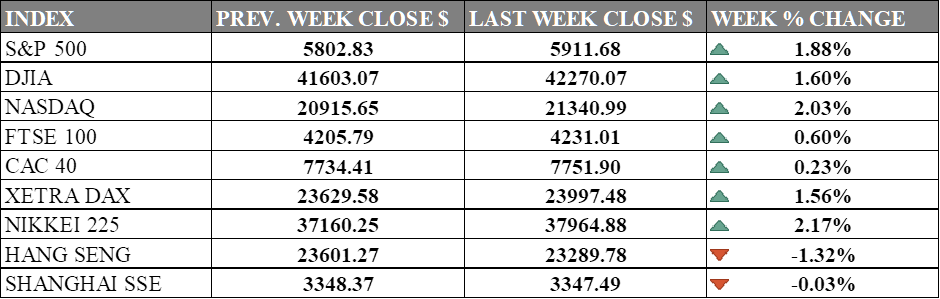

INDICES PERFORMANCE

Wall Street experienced a strong rally last week, with market confidence returning across major indices. The S&P 500 gained 1.88%, closing at 5911.68, as positive economic sentiment boosted investor confidence. The Dow Jones Industrial Average (DJIA) also posted solid gains of 1.60%, finishing at 42270.07. The Nasdaq led the advance with a 2.03% increase, closing at 21340.99, as tech stocks found renewed buying interest throughout the week.

European markets also showed positive momentum during the period, though with more modest gains than their American counterparts. The UK's FTSE 100 rose by 0.60%, closing at 4231.01. France's CAC 40 increased by 0.23%, ending at 7751.90, while Germany's XETRA DAX demonstrated strong performance with a 1.56% gain, closing at 23997.48. European markets appear to be benefiting from both regional optimism and broader global market strength.

Asian markets presented a mixed picture, with notable regional variations in performance. Japan's Nikkei 225 posted strong gains of 2.17%, closing at 37964.88 tracking gains in the U.S. tech industries. However, Hong Kong's Hang Seng Index moved against the positive trend, declining by 1.32%, finishing at 23289.78. In mainland China, the Shanghai Composite Index showed minimal movement with a slight decline of 0.03%, ending at 3347.49, suggesting cautious trading activity in the region despite the broader global rally.

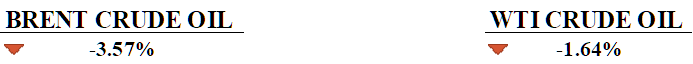

CRUDE OIL PERFORMANCE

Crude oil prices rose roughly 4% on Monday, erasing last week losses of 3.57% for brent and 1.64% for WTI amid rising global tensions and supply worries. The spike came after a significant Ukrainian drone raid on Russian military airports, heightening concerns about wider disruptions to Russia's energy infrastructure and expected retaliation. Iran is anticipated to reject a US nuclear agreement plan, which would extend US sanctions and limit Iranian oil production. Wildfires in Alberta have cut off 350,000 barrels per day, limiting global supplies. OPEC+ declared a smaller-than-expected output increase, which investors viewed as an optimistic signal, resulting in a market rise. A lower US currency and forecasts of limited future supply increases also fuelled the price hike..

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. inflation continued to ease in April, with the PCE index hitting its lowest annual rise since 2021, raising expectations that the Fed may cut interest rates later this year.

U.S. GDP contracted 0.2% in Q1 amid trade policy uncertainty, with weak growth and low business confidence continuing into Q2 despite slight improvements.

What Can We Expect from The Market This Week

US Nonfarm Payrolls: Total employment increased by 177,000 in April while the unemployment rate floated at 4.2%, according to the U.S. Bureau of Labour Statistics. Employment continued to trend up in health care, transportation and warehousing, financial activities, and social assistance, while federal government employment declined.

ECB Interest Rate Decision: The Governing Council of the European Central Bank decided to lower the three key ECB interest rates by 25 basis points for the seventh time at the last April meeting, bringing the deposit facility rate to 2.40%. The decision was based on the ECB's assessment that the disinflation process is well on track, suggesting that inflation will settle at the 2% medium-term target on a sustained basis.

BoC Interest Rate Decision: The Bank of Canada maintained its policy interest rate at 2.75% after a seven consecutive cut. The central bank is expected to hold rates steady at its upcoming meeting as policymakers await further news on an economy that grew faster than expected.

ISM Non-Manufacturing PMI: The index increased to 51.6 points in April 2025 from 50.8 points in March, exceeding market expectations of 50.2. This reading indicates continued expansion in the services sector, as any figure above 50 represents growth in the non-manufacturing economy.

US Initial Jobless Claims: First claims for state unemployment benefits rose by 14,000 to a seasonally adjusted 240,000 for the week. More people are filing for unemployment than expected, pointing toward a cooling labour market, although not considered for policy projection with other factors at play.