PAST WEEK'S NEWS (JANUARY 01 – JANUARY 05, 2024)

The U.S. job market cooled in December as interest rate hikes took effect, with job openings falling and initial jobless claims dropping to a two-month low. This is expected to continue if the Fed remains data-dependent when cutting rates. However, layoffs are low, and the unemployment rate is expected to stay below 4%, suggesting the economy is unlikely to tip into recession anytime soon. Financial markets are betting on the Fed cutting rates as early as March, partly supported by signs of an easing labour market.

The US government's debt pile just reached a staggering $34 trillion, sparking alarm on Wall Street and beyond. This "depressing achievement," as a watchdog group called it, is mounted by rising deficits and has interest payments exceeding defence spending. Policymakers face a stark choice: raise taxes, cut spending, or risk higher interest rates and slower economic growth. This debt mountain casts a long shadow over the markets and future prosperity, demanding immediate attention and decisive action, although faltering rates may provide some relief and time to adjust.

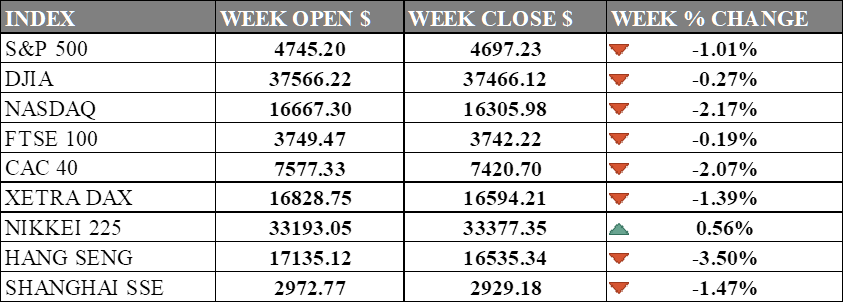

INDICES PERFORMANCE

The major U.S. stock indexes ended in negative last week with the Nasdaq falling the most while the DJIA and S&P 500 dipped although less severe. The S&P 500 slipped -1.01% to close at 4697.23, down from its open of 4745.20. The Dow Jones Industrial Average declined -0.27% to finish at 37466.12 compared to its starting point of 37566.22. The tech-heavy Nasdaq dropped -2.17% to 16305.98 after opening the week at 16667.30. The losses are attributed to profit-taking activity at the start of the year after a satisfactory gain for the year on recovery. Markets scaled back bets on early and steep rate cuts from the Federal Reserve following a strong December jobs report and Fed minutes showing uncertainty around future rate changes evidenced by a rebound in the dollar and Treasury yields.

In Europe, the major indexes were mostly lower. The UK's FTSE 100 dipped -0.19% to close at 3742.22 compared to its open of 3749.47. France's CAC 40 sank -2.07% to end the week at 7420.70 after opening at 7577.33. Germany's XETRA DAX fell -1.39% to settle at 16594.21 from its starting point of 16828.75. European stocks ended up lower on the first trading week of 2024, as traders stay cautious of federal reserve movement. Airbus are expected to profit from portfolio shifts after Boeing’s reputation plummet due to safety checks mandate after one of its jet dissembled mid-flight.

Asian indexes were mixed on the week. Japan's Nikkei 225 ticked up 0.56%, closing at 33377.35 versus its open of 33193.05 closing with its headline inflation expected to rise in December according to Morgan Stanley. Hong Kong's Hang Seng plunged -3.50% to finish at 16535.34 from its starting level of 17135.12. China's Shanghai Composite slipped -1.47% to close at 2929.18 compared to its open of 2972.77. Chinese and Hong Kong stocks continue to plummet as investor losing confidence in China’s economic recovery with reports likely to show weak economic activity. China’s trade balance on Thursday are set to provide some clarity into its economy.

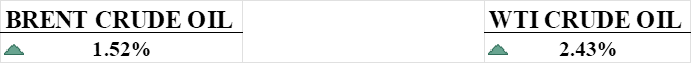

CRUDE OIL PERFORMANCE

Geopolitical tensions rising from the Israel-Hamas conflict and Blinken's Middle East visit sparked a rebound in oil prices, pushing Brent above $78 and WTI past $73 despite weaker December demand. A strong U.S. jobs report added fuel to the fire, suggesting sustained demand in the year ahead. However, long-term price forecasts and a shrinking oil rig count cast a shadow of uncertainty, urging caution for investors as OPEC+ holds its ground in the $70-$90 range.

OTHER IMPORTANT MACRO DATA AND EVENTS

Eurozone inflation unexpectedly spiked in December, defying market expectations to keep interest rates at record highs. While technicalities likely caused it, underlying pressures remain stubbornly above target. Expect a tug-of-war between the ECB's cautious guidance and market bets on an imminent rate-cutting spree, with data likely holding the key throughout the first half of 2024.

A resilient labour market, exceeding job growth expectations in December, throws a curveball at the Fed's rate-cut calculus, potentially prolonging an era of high borrowing costs despite easing inflation anxieties. While strong hiring hints at a soft economic landing, it underscores the central bank's tightrope walk battling inflation without tipping the economy into recession.

What Can We Expect from The Market This Week

US CPI December: The average basket of goods and services showed a 3.1% increase over the last 12 months in November, with expectations of flatlining. The Federal Reserve acknowledges that the latest CPI report doesn't necessarily mark the end of the inflation challenge, which is expected to keep the rate unchanged until it becomes a necessity.

US Note Auction: $37 billion of 10-year and $21 billion of 30-year Treasury Notes at a high yield of 4.296% and 4.334% revealed recovering but poor demand. This signals potential concerns about market's sentiment and confidence in the US economy, reflecting a noteworthy impact on the broader macroeconomic landscape.

UK GDP November: The UK economy showed a surprising 0.1% rise in November, likely attributed to pre-Christmas shopping and hospitality. However, this blip is unlikely to last, with forecasts pointing to sluggish growth below 1% in 2024.

US Initial Jobless Claims: The weekly count of new unemployment claims in the US fell again last week, reaching a multi-month low. This positive trend points towards a strengthening labour market, sowing doubt into early easing by the Federal Reserve.

EIA Short-term Energy Outlook: In the last report, the EIA predicted that net exports of crude oil and petroleum products would hit an all-time high in 2024, driven by U.S. crude oil and hydrocarbon gas liquids production. The report also forecasts that solar and wind generation together in 2024 will overtake electric power generation from coal.